Wolf Money(Boustead Projects)long post!

It is not my intention to keep this sharing under a cloud of secrecy but due to the need to keep the stock price in check as the liquidity of the stock is poor, any big buy up or sell down can cause the share price to move exponentially. As I looked into my crystal ball(watch) and try to guess which stock will do well going into 2023 given the high borrowing cost and possibly a recessionary environment. I find it difficult to find any company in Singapore not affected by the tough macro environment. A few critical criteria I had put out for my next search, the company must not be over leverage, in net cash position preferred, good growth and trading well below nav etc.

Boustead Projects(BP) is one such company which I had decided to put some capital to work. They are in net cash position even with their big shell out on the Bideford property(former Thong Sia building). BP is building business parks in Vietnam, a country full of potential. The build environment is operating more normally now after the disruption cause by covid over the last 2.5 years. I have accumulated shares in Boustead Projects over the past month. Boustead Projects(BP) is the sister company of Boustead Singapore which own 54% of the company. I like the company for the simple fact it is run by reputable and capable management. Simple enough to comprehend businesses were the main attraction for me. Two core businesses with one part engineering and construction business (build environment) and the other real estate business which involved them managing a private real estate fund, they owned 25% of Boustead Industrial Fund(BIF). Boustead is involved in managing properties outside of BIF on behalf of JV partners.

E&C business

The sector is recovering after lifting of covid restriction on foreign labour. Order book stood at 523m as at end of July, are close to pre covid highs. The recent 300m contract win to build an industrial building for a Fortune 500 company is likely to have a positive impact on earnings for FY2023(March closing) and FY2024. I am expecting earning for the unit to come close to pre pandemic by next FY. I am positive on the outlook for their E&C services as more companies are setting up shop in Singapore due to generous incentives given by government to have region HQ and R&D centre. A potential driver for demand may come from continuing trade war between US and China. More companies are moving out of China to avoid US tariffs on Chinese made goods and services. Singapore is seen as a neutral country by US and China, Companies from US and China can more or less stir clear of political land mine when operating out of Singapore.

Real Estate business

The real estate business comprise the manager of private property fund and a 25% ownership of Boustead Industrial Fund(BIF). There are a total of 15 industrial properties in the private fund. Other parts of their business includes ownership of industrial parks in China and Vietnam. Pipeline properties which can be injected into the fund included Alice@mediapolis, is free to inject into BIF fund from 2023. BP took out a 130m green loan from UOB last year to refinance Alice@mediapolis. Base on 80 percent financing and 20 percent equity. I derived the building to be worth around 155m-160m. Profit from the potential sale might come within the range of 40m-60m or 20-30m or 6c-9c profit per share base on Boustead Projects 50 percent stake. Alice@mediapolis is a JV with Abu Dhabi Investment Authority.

Another point of undervalued was the purchased of grade A mixed development at 30 Bideford Road for 515m with Boustead Projects owning 50 percent of the building with the rest under private equity ownership. The building was valued by property surveyor to be worth 550m. Effectively Boustead Projects can book an accounting profit of (550m-515m = 35m )x 50%) 17.5m -6.2m(additional fees) 11.3m or 3.6c per share under bargain purchase. The property was purchased with vacant procession. The building will go up in value once stabilisation of assets matured. I personally find the purchase an astute piece of business by BP. Some background on the building, Sin Capital developed the former Thong Sia building which housed the former Seiko service centre under a 380m en bloc deal. The building was sold to BP and JV upon default of mezzanine loan. To summarise, it will cost much more for anyone or BP to buy that piece of freehold land in Orchard and build another similar building in current market condition given the rising cost of construction and land, effectively the replacement cost is likely higher than what BP paid. The new building was TOP in 2020. The building excellent location is just across Paragon Mall and Mt. Elizabeth Hospital. The property is 600 meters from Somerset MRT.

There are 168 units of service apartments spreading across 12 floors. There are 3 floors of offices and 1 floor of medical suites and a ground floor for f&b. The service apartments is hitting the market at the right timing when Singapore is experiencing strong inflow of tourists/medical tourists and business travellers after lifting of covid related travel restriction end April. The average hotel room rates had jumped to 10 years high due to surging demand. I did a google search, a service apartment at 4 stars Ascott Orchard(beside 30 Bideford) charges in upward of more than $400 a night for a minimum stays of 6 nights. 168 units of service apartments at 85% occupancy rate(steady state) with minimum $400 room rates will generate at least 21m in revenue a year. Bideford service apartments are likely to command a premium rate due to its newer status.

Offices and Medical suites in Orchard are in short supply with hardly any new supply coming on to the market in the last few years. Medical suites in Orchard Road are highly prized due to it close proximity to Mt. Elizabeth Hospital. Landlord of Medical suites are charging a min of $40-$50 psf in rental at Mt. Elizabeth. I can’t confirm the numbers of medical suites in Bideford building. If I put the space at 10000 sqft, rental collected is somewhere near 5-6m a year. 3 floors of offices at going rate for grade A office of $11 psf. Another 4m will be added to the rental income. One floor of f&b 8000 sqft at $20 psf, giving a sum of about 2m revenue. Total gross rental is likely around 32m a year on steady state.(my guess work only, don’t take it as gospel truth). The building alone is likely to contribute an additional 2-3c eps to BP bottomline yearly when asset stabilisation is achieved. Having more recurring income help increase dividend payout.

The cap rate for Singapore retail and office assets, I estimated are between 4-5%. I suspect BP had purchased the building at the upper end of of the cap rate given hospitality and medical asset have higher cap rate than a pure office asset. The building was listed end of last year for sale at 600m. The property was listed under the book of former owner at 720m in March 2021. The purchase price of 515m represents a 14 percent discount from former selling price. To spend 515m or 257.5m(Boustead portion) show their statement of intent to expand their property management business into other asset class. It is the largest purchase by any Boustead Singapore group of companies in recent years. If you are a follower of Boustead Singapore, they had always acted prudently with shareholders’ money. If it is not a “Yum” deal or for my foreign readers, “money in the bank” type of deal, they wouldn’t spend any money on it. This property is likely to be a profitable purchase for the company. It also raised the corporate profile of the company with BP expanding into commercial property.

(The building was listed in the book of former owner in March 2021 for 720m and listed for sale for 600m at end of 2021 vs acquired price of 515m, felt like a double discount for BP)

(Source BT. Hotel rates at 10 years high in July)

(Source BT. Simgapore companies looking for a slice of action in Vietnam)

Another good pie of their business is their investment into Vietnam Industrial parks. Assets under management with JV in Vietnam stood at 148m vs zero 4 years ago. I have spoken about my desire for a Vietnamese play in my August portfolio update but I stop short of describing BP as a pure Vietnamese play but I am pretty confident their Vietnam Industrial Parks will be in high demand. Vietnam government forecast GDP growth to be above 7% in 2022, one of the highest in the world. MNC and Chinese companies are moving southward into ASEAN particularly into Vietnam due to US-China trade war so as to avoid tariffs on Chinese made goods and services. BP should’ve any problem growing their business in Vietnam at godspeed.

Investment

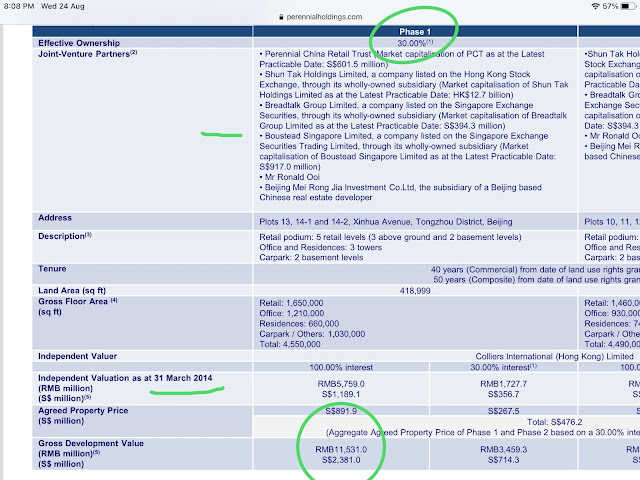

Boustead Projects own a 4 percent stake in Beijing Tongzhou development phase 1 since 2012. The estimated completion date is in 2023 and sale of the project can start at the end of this year as communicated by BP during Agm. The GDV of the project(perennial presentation) stood at $2.5b (2014 estimate),quite conservative in term of valuation even with all the problem surrounding the Chinese real estate market, the development is only 20km from Beijing city centre. BP 4% stake in theory is worth 100m, not bad for a 20m investment. Will the shareholders finally be able to see the return in 2023? There are some profit to be made from the project given the attractive entry price. I estimate profit to be in the ballpark of 40m-60m or 13c-19c per share. Finger crossed!

All signs are pointing towards a good 2023 for BP if the economy is able to avoid a hard landing, even without any corporate action, share in the company is trading at a good 30% discount to its $1.25 book value, offering a good margin of safety. BP has a very conservative accounting policy, all properties are kept at cost minus depreciation and impairment loss. $1.25 reflected in the book is on the conservative side. The rnav is much higher than the stated book value. Historically the share traded close to 1x book before covid. This is the first time in many years Boustead Project is putting their huge war chest to work. Finger crossed for better earnings and share performance again!

Warning!

The liquidity for the share is tight. Buying is hard, selling is hard too. Only suitable for people with a longer term view.

Finally after my Grandpa story, I end my thesis with a speech by the legendary Chairman of Boustead Singapore, Mr. Wong F.F on entrepreneurship and business reinvention presented 13 years ago . It is not too absurd to refer him as Singapore version of Warren Buffett. I got high admiration for his business acumen.

Part 1

Part 2

Part 3

Part 4

Part 5

Please follow us on telegram for the latest update on Lone Wolf investor by clicking on the link below

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for education only. Buyer beware,do you own due diligence.

Comments

Post a Comment