Wolf Money(Portfolio update end Sept 2023)

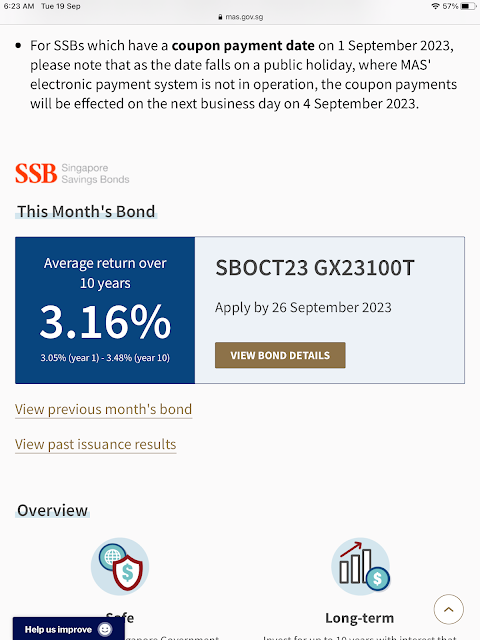

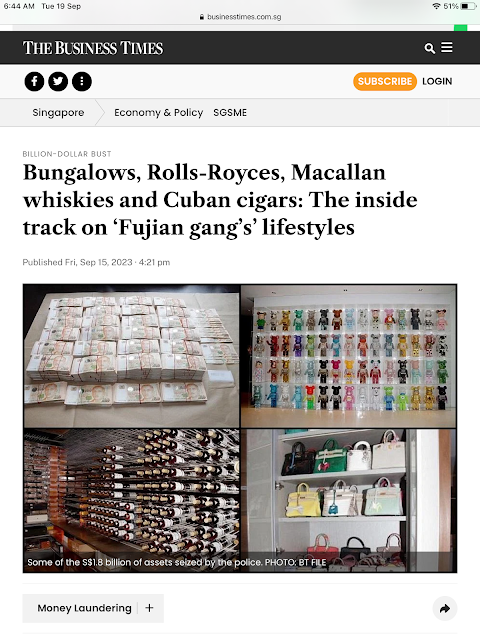

(Image credit: The Business Times) When to say no The recent Anti-Money Laundering operation by the police rounded up 10 suspects with close to $2.4b in assets and cash seized. It is one of the largest AML seizures in Singapore’s history. Over 100 luxury properties, top of the line cars, cash and gold bars were taken in as part of the operation. I am not here to talk about the case as investigations are ongoing. The case implicated many property agents. Some were suspected of direct involvement and some unknowingly got implicated in the case. Lawyers and bankers for some of those transactions are unlikely to be off the hooks too. When to say NO is a simple and yet difficult reply. For this headline-grabbing case, big money was involved. It is very difficult to say No to a property transaction worth millions of dollars where one huge deal can bring in a year’s worth of earnings. I am not condoning those agents who have broken the laws. The No reply is not as simple as No, given housin