Wolf Money(Portfolio update end Sept 2023)

When to say no

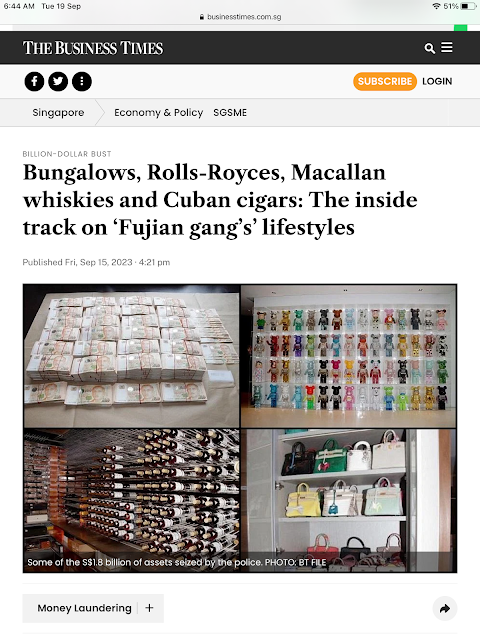

The recent Anti-Money Laundering operation by the police rounded up 10 suspects with close to $2.4b in assets and cash seized. It is one of the largest AML seizures in Singapore’s history. Over 100 luxury properties, top of the line cars, cash and gold bars were taken in as part of the operation.

I am not here to talk about the case as investigations are ongoing. The case implicated many property agents. Some were suspected of direct involvement and some unknowingly got implicated in the case. Lawyers and bankers for some of those transactions are unlikely to be off the hooks too. When to say NO is a simple and yet difficult reply. For this headline-grabbing case, big money was involved. It is very difficult to say No to a property transaction worth millions of dollars where one huge deal can bring in a year’s worth of earnings. I am not condoning those agents who have broken the laws. The No reply is not as simple as No, given housing agents have bills to pay. How does one reject a proposal that doesn’t seen right at the beginning? Any big deal with a huge amount involved will test the integrity of the person. Everyone should be able to tell on their own conscience, that small little voice in everyone could literally get anyone out of trouble. Without integrity and honesty, the law will catch up on those engaging in shady deals.

There is another type of No which I find it useful to say. One shouldn’t have an embarrassment of saying no to friends or relatives when it comes to friendly loan. I reject any proposal for any friendly loans. That might explain why I had fewer friends. Friends with a need to borrow regularly wouldn’t come to me now. I find saying No to friendly loans quite helpful in growing genuine relationships. All that borrowing and lending is a recipe for destroying relationships/friendships. Friendly loans go unpaid, turning into a cat and mouse game between friends and relatives is an unpleasant situation no one should ever go through. A person that goes around borrowing money and goes missing in action can’t be a good person to continue a genuine friendship. Friendly loan doesn’t bring financial wellbeing to yourself and your family. All those unpaid loans could amount to a substantial figure. Those soured loans could be spent on your loved one or increase one’s retirement adequacy. I have a friend whom I admired him for his kindness and willingness to help his friends had stories of his own to tell me. He was approached regularly for friendly loans to a point that it became too regular for him to pay for others’ gambling debt, credit card debt, even payment of hush money to a friend’s mistress. He was even approached by a friend’s wife for help. In the end, most loans went unpaid and friend’s wife who became an ex-wife later, rejected any responsibility for the loan taken after they got separated. That particular incident hardened his view of not offering any friendly loan to anyone anymore. There are more ways to help a friend in need, offering friendly loan is not one of them in my opinion unless one is willing to handle the unpleasantry, the emotional roller coaster of a friendly loan and friendship litmus gone bad.

There was a recent court case involving two SGX listed companies bosses over a $2.4m unpaid friendly loan. It is a reminder how close ties between 2 families could be broken over money. To avoid any uncomfortable situations, no borrowing and no lending should be the basic conduct for all relationships. Finally, when someone asks for a friendly loan, that person will call you Papa, when you desperately need the loan to be returned, you have to call that person Papa. That is Lone Wolf’s Musings for you.

Lone Wolf Fund(LWF)

Portfolio as at end of September

1.) Cash

2.) SBS Transit

Commentary

My thoughts and prayers to those who got affected by the earthquake in Morocco and the flood in Libya. May those affected find solace in God.

The ghost of high inflation which started last year refuses to leave us for good. There was renewed strength in oil. With oil being the mother of all commodities, as higher fuel prices affect prices of almost all commodities. Soft commodities like coffee and rice are trading close to multi-year highs. It will translate into higher cost of living for all global citizens. With elections in western economies around the corner, there will be pressure by their own citizens to stop supporting Ukraine with huge financial assistance. Most will argued, why help fight others’ war when your own government finances are weakening? There is no way any western government can support Ukraine financially and perpetually without the backlash from its own electorates. Unfortunately or fortunately for Russia, she has the liberty of time on her side, fighting this long war.

The UK for example, is facing dire financial challenges due to the large amount spent during the covid period and the resulting Brexit pushed up cost of doing business due to additional taxes on EU imports. The withdrawal of VAT refund for tourists cost the UK government $1b pound of additional tourist dollars, that left a gapping hole in the government budget. Birmingham, Britain’s second largest commercial city, has declared bankruptcy. The council had no money to run essential services. The election season in Europe is likely to usher in more right-wing parties.

Boustead Singapore

Como Orchard has finally opened after subtle improvements was made to the building. I liked the modern look of the building. The property welcomes its first guest to its hotel on the 1st of September. Cedric Grolet had opened a pastry delicatessen in the building. The Michelin Star Chef is drawing large crowds to Como Orchard. Queues were seen during my trip to the building. With higher footfall, the property is going to generate a steady return for Boustead Singapore.

SGX has direct Boustead Project to delist from the stock exchange for failing to increase its public float to a minimum 10%. Boustead Singapore has one month from 26 Sept to come out with a fair and reasonable exit offer for minority shareholders of Boustead Project. We should have clarity on BPL by 25 Oct.

There was a new addition to Lone Wolf Fund this month. I bought just enough shares in SBS Transit to generate enough dividend for my family’s public transport fare. I had done a short write up. Kindly click the link.

I had a good read of the annual report. I found out a couple of interesting points. First, LTA is leasing 2900 buses from SBS Transit for a fee that is equivalent to the annual depreciation amount. SBS Transit then uses the fleet to fulfil their obligations under the bus contract model, which will also earn them a fee. Secondly, public transport companies are given a grant for the deferment of the full hike in transport fare, literally the public transport companies are compensated for the deferment. The larger the deferment, the larger the grant. It does seem like the transportation business is a good business to be in. Given the big raise in fare, public transport companies are going to experience better cashflow. Will they make a lot of profit? Unlikely. Will they be making steady profit? Yes, very likely. What I like about their business is predictability and the certainty of payment given LTA is the counter party. The huge cash in the company is also generating earning for the company. Just base on $340m, at 3% deposit interest, the company will be generating interest income of more than $10m.

(Increase of additional grant from $200m last year to $300 this year)

All the above factors had contribute to the strong cash flow. The company generates in excess of $200m in operating cash flow per year but only $24m was paid out as dividend last year. Cash on hand has been increasing at a rate of more than $100m a year over the past 2 years. There is more scope for the company to give higher normal dividend payout. I personally view the 50% payout ratio as conservative. They should have no problem doing a 60%-70% payout without breaking a sweat under normal circumstances but I suspect the company might be laying low on dividends since it might be bad optics for public transport operators to give out big dividends after a big fare hike. I am somewhat positive on them making some sort of one off special dividend to celebrate their 50th years anniversary. Fingers and legs 🤞.

Cash

I continue to roll over some lower yielding SSBs to the higher yielding SSBs this month. Cash yield continue to increase. I have deployed a small amount of capital into SBS Transit as mentioned.

Summary

As for the Singapore market, property related companies will have to undergo a painful adjustment in value due to some problematic commercial properties held on books. Given our market is heavily focused on properties, couple with the slowing Singapore economy which is projected to grow at only 1% this year, it will be hard for our market to make any headway till the trend of rising interest rate reverses. Our three index heavy, local banks, are giving support to STI, without them holding the Royal Standard, STI would be trading nearer to the 3000 level.

Lone Wolf Fund ytd gain stood at 5% (excluding dividend and cash yield), down 0.5% from last month. I will continue to maintain a high degree of discipline on the type of investment I will be making. The current market condition is difficult to navigate given there are a lot of moving parts. I am unlikely to move big on any stock until I get a clearer picture from Corporate Singapore year end result. I suspect some heavy write off in property and inventory value in some property and manufacturing related companies to put further pressure on their share price. It is also important to look at the charge off rate in our banks especially those banks with exposure to the Chinese property market. I emphasise more on balance sheet strength and less on high dividend yield. Sometimes high dividend yields might be the first sign of trouble, it is one such occasion to say no to those companies. God bless everyone.

Please consider following us on telegram for the latest update on Lone Wolf investor by clicking on the link below. No form filling, no payment required, no collection of data, no data mining, no hard selling, no obligation.

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for education only. Buyer beware,do you own due diligence.

Comments

Post a Comment