Wolf Money(portfolio update for end Aug 2023)part 2

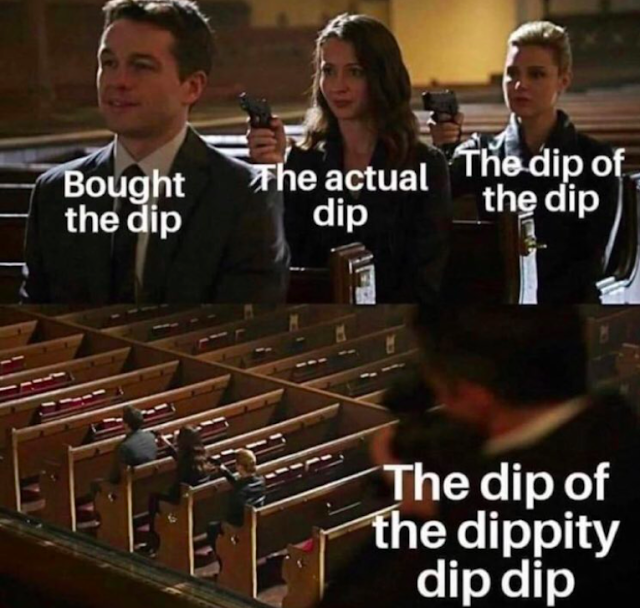

(Image credit: NFTnow.com; Bargain hunters’ greatest nightmare) Lone Wolf Fund(LWF) Portfolio as at end of Aug 1.) Cash 2.) Boustead Singapore(BSL) *Stocks are not rank in accordance to capital invested . *Just for sharing. Not an inducement to buy or sell . Commentary Wall Street was feeling the weight of its gain from July with substantial correction in early August. The comeback towards the end of the month reduced much of the losses. Our market had a weak month, index was down around 4.5%. The Reits market was feeling the impact of high borrowing costs with many local Reits experiencing high single to double percentage losses in distribution income per unit. With the slowing economy in Singapore, the second half is likely to see the full impact of the high borrowing costs and increased vacancy rates. The upward adjustment of cap rates in some problematic commercial real estate segments might be imminent given the substantial drop in npi. The adjustment will have a negative