Wolf Money(world market review 14-20 Aug 2023)

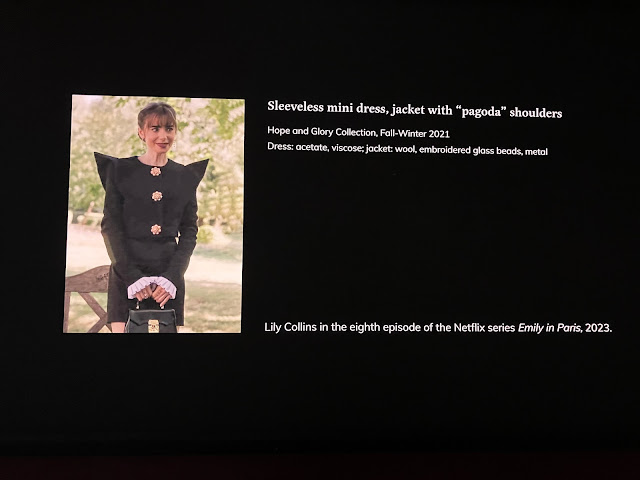

Donation by Andrew Gn

Collection of Asian Civilisation Museum

Market Summary 14-20 Aug 2023

🇺🇸 🇺🇸 🇺🇸 🇺🇸 🇺🇸

- Conference Board said its Leading Economic Index fell 0.4% in Jul after declining 0.7% in Jun, down for 16th straight mth

- Fed remains concerned over unacceptably high inflation, signals potential more rate hikes to cool inflation: FOMC minutes

- US expects to pay record amount of interest from US$475bn in fiscal year 2022 to US$1.4 trillion in 2032 on its national debt

- US top banks like JP Morgan n BofA could be hit with rating cuts due to industry’s deteriorating health: Fitch

- US average rate for 30-year fixed mortgage now at its highest level in >20 years at 7.09%

+ USD set for 5th straight week of gains in longest winning streak for 15 mths

+ SEC set to adopt transparency rules for the US$20 trillion private investment fund industry

- US steps up scrutiny on China EV batteries, components under law on Chinese forced labour

- US imposed import duties on solar panel makers who finished products in SEA nations to avoid tariffs on Chinese made goods

+ Goldman Sachs estimates US home prices to rise by 1.8% this year due to limited inventory, stronger-than-expected demand

- US to impose tariffs on tin-plated steel imports from China, Canada and Germany

+ US 3 largest airlines plan to double number of flights to China

- US drops effort to include anti-whaling language in Indo-Pacific pact

- Cathie Wood’s ARK Innovation ETF down 20% for mth Aug; tech sell-off, rising Treasury yields

+ SpaceX turns profit in Q1 as revenue soars after 2 annual losses: WSJ

- WeWork to proceed with one-for-forty reverse stock split to regain compliance with listing requirements

🇨🇳 🇨🇳 🇨🇳 🇨🇳 🇨🇳

+ China set to cut lending rates; expected to target mortgage-linked loan prime rate to support sentiment

- China is assessing impact of US investment restrictions on high-tech sectors, may take countermeasures: Commerce Ministry

+ China’s Jul industrial output up 3.7%, retail sales grow 2.5% YoY

+ China retail sales of services surged 20.3% YoY in Jan-Jul period compared with 7.3% for overall retail sales

+ China unveiled measures to boost stock market; cut trading costs, supports share buybacks, encourage long-term investment

+ China major banks offloading dollars onshore and offshore this week to buy yuan and slow weakening of yuan: Reuters

- China’s US Treasury holdings in Jun hit 14-year low at US$835.4bn

+ China’s banking institutions report growth in total assets, up 10.4% YoY

+ China net inflow of FDI rebounded in Jul to 2nd highest level in nearly a year

+ China to extend special loan program until May 2023 to support ailing developers

+ China developers’ difficulties are temporary; risk set to gradually dissolve amid policy adjustments: NBS

- Evergrande filed for US bankruptcy protection for US$32bn debt overhaul, citing does not involve bankruptcy petition

+ GZ mulls housing vouchers to revive home market

- China suspended publishing youth unemployment figures, citing to review the methodology

+ China’s outbound direct investment up by 18.1% YoY to ¥500.9bn: MOC

- Chinese trust firm Zhrong Int’l, managed assets worth US$108bn end 2022, has missed payments on dozens of products

+ China launched first shipping futures product The Containerized Freight index Futures Contracts listed trading at Shanghai INE

+ China to boost robotics industry with raft of policy measures, seek to speed up innovations and breakthrough

+ China will see busiest travel market in 5 years, estimated 1.8bn domestic trips from Jun to Aug, projected generate ¥1.2 trillion: Tourism Academy

- China launched military drills around Taiwan after vice-president’s US visit

+ Chinese flying car maker EHang completed all necessary tests, closer to take off for commercial use

+ China’s summer box office hits record high at ¥18bn this week vs ¥17.779bn same period in 2019

+ Alibaba, Tencent renew hiring as big tech gears up for growth

- HK stocks log worst week since Mar amid China debt woes, yuan slide

- Taiwan sees economic growth this year at slowest in 8 years

🇯🇵 🇷🇺 🇦🇷 🌍

+ Japanese economic growth in Q2 expanded 1.5% QoQ, fastest rate since 4th qtr of 2020

+ Japan’s core consumer prices rise 3.1% in Jul YoY

- Japan’s trade balance fell back into deficit of ¥78.7bn in Jul as exports dropped for the first time in >2 years

+ SoftBank Gp acquired 25% stake in Arm Ltd does not directly own from its Vision Fund valued at US$64bn ahead of IPO

- Russia’s central bank hiked its main interest rates by 3.5% pts to 12% after ruble hit 17-mth low

- Russia considering partial capital control measures to stem ruble’s slide: Bloomberg

- Russia auto dealer Avtodom could launch production at former Mercedes-Benz plan in Moscow with new partners next year

+ Russia former BMW, Hyundai and Kia Avtotor plant launched production of Chinese commercial JMC vehicles

- Russia taken temporary control of Baltika Breweries, owned by Carlsberg Gp

- Argentina to freeze crude price at US$56/bbl to curb inflation: sources

+ BRICS expected to roll out deepened cooperation mechanism on currency, in push to reduce reliance on dollar

- Bitcoin hit fresh 2-mth low as world markets sell off

🇪🇺 🇩🇪 🇬🇧 🇳🇱

+ Eurozone GDP grew 0.3% in 2nd qtr; latest estimate published by Eurostat

+ Eurozone swung back into large trade surplus of €23bn in Jun as imports from Russia and China fell sharply

+ EU hits gas storage target before Nov deadline

- ECB to raise objections to Italy’s windfall tax on banks’ profit

- German economy will remain stagnant in H2 due to lower demand, tight monetary policy, prolonged energy crisis: Bloomberg

- Germany govt issued new gas price warning: Bloomberg

- Germany’s skilled labour shortage worsens: survey of nearly 9000 firms

+ UK inflation fell to 17-mth low of 6.8% mainly due to lower energy prices

- UK jobless at 4.2% in 3 mths to end Jun compared to 4% in 3 mths to end May

- UK public debt load soared >40% to almost £2.6 trillion since pandemic struck

+ UK biggest weapons makers BAE to acquire aerospace division of US Ball Corporation in US$5.55bn cash deal

- Netherlands GDP shrank 0.3% in Q2 after 0.4% contraction in Q1, entered technical recession

🇮🇳 🇸🇦

- India imposed 40% export duty on onions with immediate effect

- Saudi Arabia’s oil exports to 21-mth low, exported totalled 6.8m bpd in Jun, down of 124,000 bpd compared to May

🇮🇩 🇹🇭 🇻🇳 🇲🇾 🇸🇬

+ ASEAN to start Defa talks to boost digital economy, unlock US$2 trillion by 2030

+ ASEAN carbon neutrality can unlock US$5.3 trillion economic opportunity: economic ministers

- ASEAN imports from China have plunged for 3 straight mths YoY basis, down 15.9%, 16.9%, 21.4% in mth May, Jun, Jul

+ Indonesia leader to attend BRICS summit amid talk of group’s expansion

+ Jakarta-Bandung HSR now undergoing intensive joint commissioning and testing, paving way for commercial operation

+ Thailand’s economy likely grew 3.1% in Q2 YoY, up for 2.7% previous qtr on higher tourist arrival: Reuters poll

+ Thailand first refined oil project in northeast, built by China Petroleum, went into operation with capacity of 6m ton per year

+ Thaksin to return to Thailand next Tuesday: daughter

- Vietnamese EV VinFast debuts on Nasdaq via a SPAC deal with Black Spade valued at approximately US$23bn

+ Malaysia economic growth weakest in nearly 2 years in Q2 at 2.9% due to sliding exports and global slowdown

+ Malaysia MRT Corp to do feasibility study for building an underground line for Penang LRT in city centre and undersea line

+ PM Lee: No delay in timetable for succession plan

- Sg Jul key exports fell 20.3% in steepest slide since Jan

- Sg S$1bn in cash and assets seized and frozen, 30 foreigners probed for money laundering and forgery

+ Sg July visitors arrivals grew to 1.4m on strong return of Chinese travellers

+ Sg SMEs to get carbon-accounting funding support by year-end

+ SGX H2 profit up 23% to S$286.3m

Contribution by Derek@valueinvestments chat group. Thank you

Please consider following us on telegram for the latest update on Lone Wolf investor by clicking on the link below. No form filling, no payment required, no collection of data, no data mining, no hard selling, no obligation.

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for education only. Buyer beware,do you own due diligence.

Comments

Post a Comment