Wolf Money(Banyan Group)detail

I bought an initial interest in the company. As promised, these are the pros and cons of the company.

Pros

1.) The value of Banyan Group centred around the 4 square km of land in Phuket which they had acquired in the late 80s. The estimated value of that piece of land currently stands at $4b to $5b in the words of the management. The value of land has been kept at historical cost.

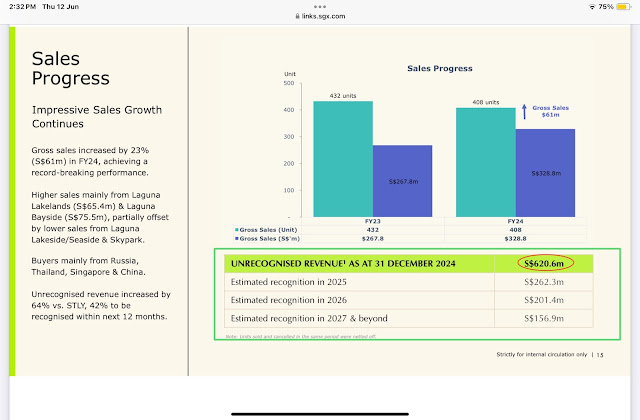

2.) The company has been slowly monetising the Phuket land through residential sales as a developer. This year they are going to book a revenue of $262m on the sale of their projects in Phuket, which is double of what they achieved last year. In total, $620m worth of residential projects were pre-sold. The sales will be booked progressively over the next three years. Their 86%-owned subsidiary, Laguna and Resort PCL reported a close to 250% jump in profit for Q1 25. Laguna and Resort PCL is the largest contributor of profit to Banyan Group. Laguna good result in the first quarter gives Banyan Group a good base to build on for 2025.

3.) The company is backed by powerful middle eastern shareholder. Qatar Investment Authority has been a long-term shareholder for more than a decade. The relationship with QIA is an important one as it opens doors for Banyan Group in MENA. QIA is a substantial shareholder of Accor with which the Banyan Group have a working relationship. Both are involved in joint venture to manage hotels in Middle East. Residential projects run by well-known international hotel chains are sold like hot cakes in Dubai. With some units going at double the price vs a non-branded residential. Banyan Group is expanding into the Middle East with greater purpose. QIA is a buyer/owner of the iconic Raffles Hotel in Singapore and other well-known hotels around the world.

4.) Banyan Group has an asset-light business with 90% of their hotels and resorts managed on behalf of hotel owners. This means the company is unlikely to be heavily geared. Based on my calculations, their gearing is around 25% at the time of writing.

5.) There were talks just last year about the company looking at some restructuring of their legacy hotel assets into a separate company to give it a clearer corporate structure.

6.) There are currently 31 hotel management projects slated for opening in the next few years. China’s domestic tourism is booming due to poor economic conditions. The resort and spa themes are catching on in China. They are expanding aggressively into China.

7.) The recent privatisation wave in SGX has put the spotlight on those under-appreciated companies. Amara Holdings was taken private at a 33% premium to the last traded nav. Banyan Group is trading at 60% discount to the nav. Stock is valued at 8x p/e currently.

8. The company is run by visionary Chairman, Ho Kwon Ping and his wife. They pioneered the Asian resort hospitality concept. I did a book review on Ho Kwon Ping last year. You can read about his story here.

Cons

1.) No stock is perfect. The dismal performance of Banyan Group share didn’t happened overnight. It has been an ongoing issue.

2.) The dividend yield is at a low 3%. Given the company has moved towards an asset light business. Shareholders will like a bigger payout.

3.) The lack of interest and liquidity in the stock is a problem, then again, is happening to many other undervalued small and mid-cap stocks in our exchange.

4.) Low shareholders’ return over the past 10 years with covid restrictions having a financial impact over the last 5 years.

Banyan Group has the magical power to turn a piece of seemly unattractive land into a valuable real estate visited by many. The business is not without risk, the stock has a lot to prove to win back investors’ confidence especially with the current price still way underwater from the IPO price of 97c. Major support can be seen at 33c-35c level.

Please consider following us on telegram for the latest update on Lone Wolf investor by clicking on the link below. No form filling, no payment required, no collection of data, no data mining, no hard selling, no obligation.

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for education only. Buyer beware,do you own due diligence.

Comments

Post a Comment