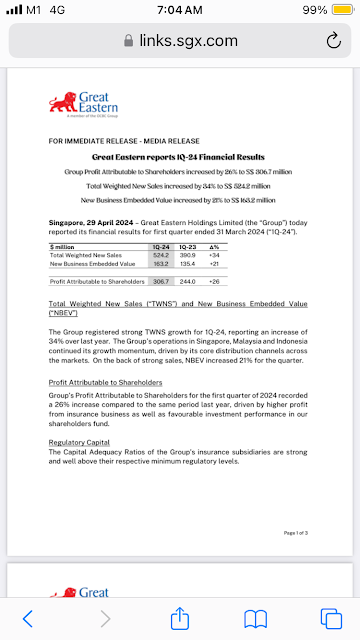

Wolf Money(Great Eastern Holdings Q1 2024 result)

https://links.sgx.com/FileOpen/20240429_GEH_1Q24%20Financial%20Summary.ashx?App=Announcement&FileID=800968 News just out this morning. Great Eastern Holdings reported a 26% increase in Q1 profit due to a more favourable market condition. The 34% increase in new sales also drove up the profit. Base on current run rate, achieving 1b net profit for FY2024 is a possibility. Overall a Great result. More detail at the end of month portfolio update. God bless. Please consider following us on telegram for the latest update on Lone Wolf investor by clicking on the link below. No form filling, no payment required, no collection of data, no data mining, no hard selling, no obligation. https://t.me/joinchat/oCgkD3sQFRMzMWM1 Disclaimers All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent invest