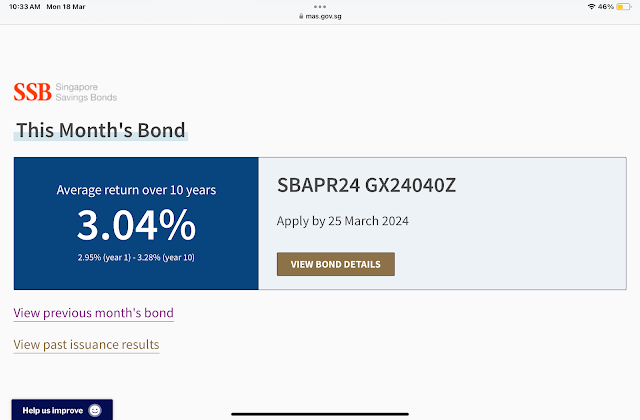

Wolf Money(Singapore Savings Bonds for April 2024 result)

Not surprisingly the April SSBs saw an uptick in demand from last month due to slightly higher yield. Overall the April issue was under subscribed by 70%. Only 30% of April issue found buyers. If nothing goes out of the norms, May issued SSBs will come with higher yield. Please consider following us on telegram for the latest update on Lone Wolf investor by clicking on the link below. No form filling, no payment required, no collection of data, no data mining, no hard selling, no obligation. https://t.me/joinchat/oCgkD3sQFRMzMWM1 Disclaimers All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we b