Warning !!! long post

Lone Wolf Fund(LWF)

Portfolio as at end of May 2021.

1.) Nam Lee Pressed Metal

2.) Pico Far East (hk.0752)

3.) Singapore Medical Group

4.) Cash

*Stocks are not rank in accordance to capital invested.

*Just for sharing. Not an inducement to buy or sell.

Commentary

Most markets went through a volatile month of May. With Nasdaq and tech stocks starting the month with some heavy correction. STI was not spare from the volatility. By middle of May our index was close to 7 percent down from April due to confluence of negative factors arising from weakness in US market and our government reimposing a partial lockdown due to surging covid-19 cases. It caused STI to drop quickly as the market participants reassess economic and market risks associating to the partial lockdown. A big crash in cryptocurrency occurred in May. At the lowest point bitcoin was down 40 percent from its high. In general cryptocurrency had a bad month. US market recovered towards the later half of the month, gaining back most of the loss ground, market is only down marginally due to less sanguine jobs data coming out of US. The inability of the economy to generate large number of jobs are seen as less inflationary thus predicting the US Fed to stay the course toward low interest rate for a longer period. A drop in 10 years bond yield also aided recovery in the US market . STI recovery was sparked by a drop in covid 19 infection rate. Market are foreshadowing a short term partial lockdown to be less disruptive to the economy. Government came out with another covid support measure worth 800m to help businesses late May also help sentiment. STI is down less than 2 percent in May. Overall I am neutral on the market. There are too many moving parts in the market to be optimistic or negative.

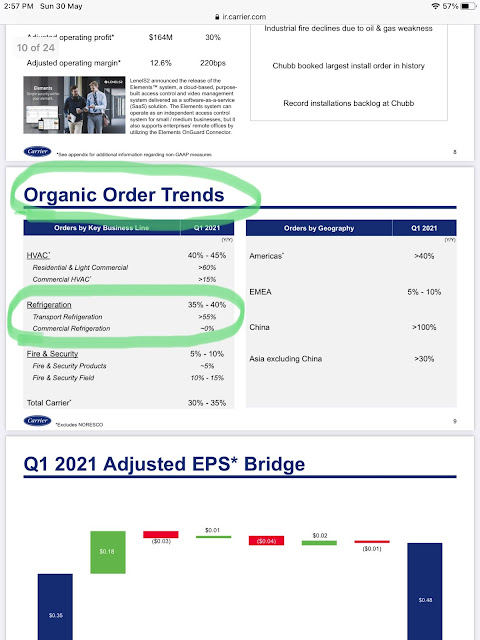

Lone Wolf Fund was fortunate to be marginally up with Nam Lee giving LWF a lift. Nam Lee half year result was up an impressive 6200%. The company is positive on its outlook for the next 12 months given the high demand for their refrigeration container frame. Major customer Carrier Global Corp is forecasting strong sale in refrigeration container for upcoming q2 and q3. Nam Lee is quadrupling the of size of their new factory in Singapore. The new factory will be fully operational by end of this year. Imho if the business ain’t doing well who is in the right mind to expand their factory footprint by 4x? The former chairman and current advisor to the group is known to be very prudent and low key among his peers. His daughter had taken over the chairmanship since last year. I hope Nam Lee new management can be more proactive in engaging investors and to address the chronic undervalued of their shares. I had round up my holding in Nam Lee in May after the extraordinary result. I am forecasting the company to make about 15-16m this year, about 6c-7c eps. They should have no problem paying 2-2.5c dividend per share for the coming year. Nam Lee is trading close to 6-7% forward yield and 5x forward p/e at current price. Nav increased to 62c in the latest result. All been said Nam Lee is not going to move up like a rocket but it does provide overall stability to my portfolio due to low beta of the stock. The good dividend make holding the stock more bearable.

(Carrier Global Corporation Q1 presentation slides)

The new addition to the LWF is Singapore Medical Group(SMG). I made an initial investment in SMG after they creased discussion with a third party for potential corporate action pertaining to a deal involving shares in the company. The share had dropped from the recent high in mid February of 42c to a low of 30c recently. Currently the share is trading at close to 1x book value which make SMG one of the cheapest medical stock trading in SGX. The company reported a 22 percent rise in net profit during the first quarter of 2021 ended March. Net cash had grown to 18.4m approximately 3.8c per SMG share. The management is still committed to enhancing shareholders value through corporate action. SMG can potentially be an attractive takeover target for any international healthcare group who seek an entry into the high growth ASEAN healthcare market. There is a shortage of doctors in Singapore where our public hospitals had to engage services of foreign doctors. The shortage had lead to long waiting time for an appointment at public hospital. Given the situation, it does give private healthcare providers like SMG pricing power due to shorter waiting time for patients who can’t afford to wait months for an appointment. Public hospitals have farmed out some diagnostics services to private healthcare providers due to manpower shortage. I am also certain if the covid 19 situation were to recede. Business and medical travellers will be the first to be allow into Singapore before leisure travellers are welcome. That welcome notion will help improve SMG business which had 1/5 of their business coming from foreigner patients seeking medical services in Singapore. I will observe their business over the next 3-6 months to see if growth continue to hold. The shareholdings in the company is quite interesting which warrant further investigation. No single party holds more than 25 percent. More informations can be found in my previous blog on SMG.

(Screenshot of SMG Q1 corporate update)

Things to watch out for month of June. Pico Far East will be reporting their first half 2021 result around late June. I am expecting a substantial improvement in their China business. If there is no profit warning before their result announcement, the company will be on the right path to partial recovery. I am forecasting China business to make up 60-70 percent of their revenue and profit. Pico Far East is trading just above -2 standard deviation away from the average historical book value around 1.7x. The share might get a lift even if only partial recovery take place. I have a way to monitor Pico business and my observation, business is showing improving. Anyone know my simple method? It doesn’t require rocket science and one need not be as good as the detectives living in 221B Baker Street. Just some common sense csi. Email me via the contact form if you have the correct answer. The first person with the correct answer get a set of coffee and toast from me.

(Coffee and toasty awaits the winner........)

Congratulations 🎉 you had endured till the end of my post. You have what it take to be a successful investor. A successful investor is also someone that loves to read. Till we meet again. Have a profitable month ahead. God Bless. Stay safe and healthy.

Please follow us on telegram for the latest update on Lone Wolf investor by clicking on the link below

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for information only. Buyer beware,do you own due diligence.

Job openings as advertised?

ReplyDeleteGS it is not the job opening. The information I am getting is more direct and it is available in public domain.

Delete