Wolf Money(world market review 11-18 July 2021)

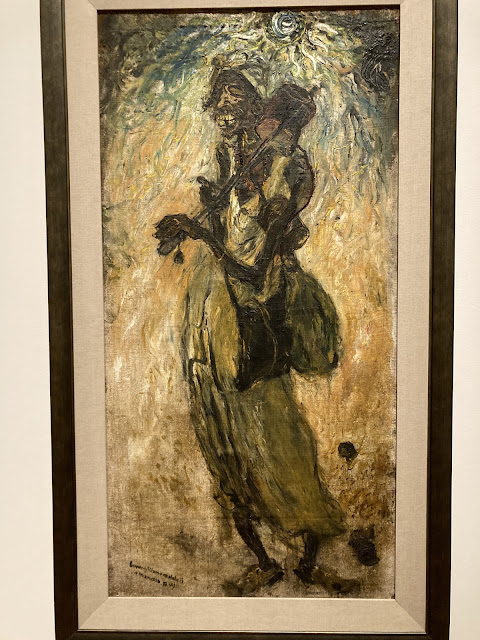

Affandi Indonesian 1907-1990

Burong Hitam, Matahari, Manusia (Black Bird, Sun, Man) circa 1950

Collection of the National Gallery Singapore

Market Summary 12-18 Jul 2021

🇺🇸 🇺🇸 🇺🇸 🇺🇸 🇺🇸

- US CPI hit its highest pt since 2008, reporting 5.4% YoY, used-car prices made up >1/3 of growth in top-line inflation

+ US added 850,000 jobs in June, unemployment rate rose to 5.9%, wages up 0.3% for the mth and 3.6% over the year

- Fed will continue to provide stimulus until economy fully recovered, even inflation has hit the highest rate in over decade

+ US retail sales rose 0.6%, unexpectedly increased in June as demand for goods remained strong

- US consumer sentiment fell sharply and unexpectedly in early July to lowest level in 5 mths on inflations fear

+ US business inventories increased solidly in May, autos stocks declined

- US to warn firms of increasing risks of operating in HK

- US Senate Commerce Committee asked Airlines to explain worker shortages despite receiving billions in pandemic bailouts

- US preparing to impose sanctions on 7 Chinese officials over crackdown on democracy in HK: source

+ Yellen to meet with regulators to discuss “interagency work” on stablecoins

- FAA says new Boeing production problem found in undelivered 787 Dreamliners

+ Delta Air Lines reported Q2 profit of US$652m, breaking 5-qtr streak of losses

+ Intel in talks to buy semiconductor manufacturer GlobalFoundries for about US$30bn

+ Broadcom in talks to acquire closely held software company SAS at US$15-US$20bn

+ Apple and Goldman Sachs in partnership to start a ‘Buy Now, Pay Later’ (BNPL) service

+ Apple asked suppliers to build 90m next-generation iPhones this year, seeking up to 20% increase in new supply

+ Google ramping up cloud infrastructure in India with 2nd cluster of data centres

+ FB would spend US$1bn on social media cerators through end next year in fight for top talents

+ Netflix planning expansion into video game market

+ American Airlines cancelling extended leaves for 3000 flight attendants, calling them back to work in time for holiday season

🇨🇳 🇨🇳 🇨🇳 🇨🇳 🇨🇳

+ China’s GDP rose by 7.9% in Q2, exports rose 32.2%, imports surged by 43% in June

+ China’s retail sales climbing 12.1% in June, beverages the fastest-growing sector soaring 29.1%

- China promised to take necessary measures in response to latest US blacklisting of Chinese companies

- China vowed to crack down on commodity hoarding, malicious speculation and price hikes to curb rising prices

+ China’s test of sovereign digital currency reached total transaction value US$5.39bn

+ PBOC: foreign visitors no longer need to open bank account to make e-payment in China

+ China to explore cross-border payments in digital yuan, willing to discuss setting global standards for digital fiat currency

+ China considering trial would allow qualified foreign institutions to invest offshore yuan in Shanghai’s STAR market

+ Chinese households have accumulated US$47 trillion in savings, while govt is gradually allowing citizens to invest overseas

+ China’s FDI soared by 34% to US$91bn YoY in H1: Ministry

+ China Southern Airlines to be country’s first to test IATA Covid Pass

- China aims to sell nearly 99% of Anbang’s remains, valued at US$5.3bn now

+ China major ports saw robust container throughput in H1, with posting annual growth rates >20%

+ China launched construction of world’s first multi-purpose small modular reactor in Hainan

- Anhui plans to shut down all cryptocurrency mining projects within next 3 years due to power supply shortage

+ China to release >10m tons of coal from its reserves for summer peak electricity demand to guarantee supply

+ China’s national carbon market made its debut with turnover of ¥210m in 1st day trading

+ Chinese glove makers new order inquiries surging by 10-20% in weeks mostly from US and Europe

+ China to exempt HK IPOs from cybersecurity checks

- China dispatched a team of officials to conduct on-site inspections at Didi as part of probe

- China’s antitrust regulator to order Tencent music streaming arm to give up exclusive to music labels: source

+ Tencent makes foray into semiconductor chip business

+ XIaomi ranked no. 2 for first time in global smartphone market in Q2, overtakes Apple by 3% in global shipments

- HK customs busted 1st suspected money laundering syndicate involving Cryptocurrency

+ Taipei grade A office vacancy rates dropped to 21-year low of 1.9% in Q2, supported by demand from tech firms, tight supply

+ TSMC said revenue would grow at least 10% sequentially this qtr to another record high

🇯🇵 🇷🇺 🇨🇺 🌍

- BOJ cuts this fiscal year growth, outline new scheme aimed at boosting funding combating climate change

+ Russia and US trade turnover jumped 7.7% in Q1 YoY to US$3.88bn despite sanctions

+ Russia Nord Stream 2 pipeline to be completed in Aug

- Cuba’s economy shrank by 11% in 2020, sharpest contraction since the collapse of Soviet Union

+ OPEC+ agrees to boost output after Saudi, UAE end standoff

+ OPEC+ projected global oil demand to grow by 6m bpd in H2, reaching pre-pandemic levels by 2022

🇪🇺 🇩🇪 🇬🇧 🇫🇷 🇸🇪

+ EU commission to delay its plan to propose EU digital tax as awaiting for global deal on fairer taxation

+ EU unveiled ambitious plan to reduce greenhouse gas emissions by 55% from 1990 levels by 2030

+ EU hopes to come up with a list of “high impact and visible projects” to rival the BRI

- EU court said Russia’s access to OPAL gas pipeline should be limited

- EU automakers sold almost 2m fewer cars in Europe in H1 compared with 2 years ago prior to Covid-19 pandemic

- German banks are rapidly cutting back office space as rising number of staff work from home

+ UK inflation soared 2.5% in June, highest rate since Aug 2018, from 2.1% in May

+ UK’s exports to EU rose in May to their highest level since Oct 2019

+ UK average household wealth rose by £7800 due to asset price rises

- UK small shops are facing £1.7bn debt mountain

- UK police seized record hauls of cyrpotcurrecny totaling £294m as part of investigation into money laundering

+ Richard Branson’s Virgin Galactic announced would raise up to £360m through selling shares

- Frances fines Google €500m for failing to negotiate “in good faith” with media companies over use of their content

+ Ericsson unveiled US$8.3bn its biggest single contract ever, to provide Verizon equipment for its 5G network

🇳🇿 🇮🇳 🇰🇷 🇪🇬

+ NZ ends QE program nearly a year after implement; the NZ$100bn program wasn’t expected to end until June 2022

+ AIIB, Chin-backed Asian Infrastructure Investment Bank makes first move into Sub-Saharan Africa

- India banned MasterCard from adding new customers over data storage breach

+ Bank of Korea said would discuss raising its key interest rate from next meeting in Aug

+ Samsung considering 2nd Texas site for US$17bn US semiconductor plant

+ LG Chem to invest US$8.7bn through 2025 in green products

+ Egypt’s Suez Canal netted record US$5.48bn in past tax year

🇮🇩 🇹🇭 🇲🇲 🇲🇾 🇸🇬

- SEA economy’s growth could significantly hit by Covid Delta Variant: Goldman Sachs

+ Indonesia estimates amount of debt issuance this year will be 18% less than initial target with higher tax collection

+ Indonesia palm oil exports reached decade high to around US$3bn in May, accounted almost 1/5 of country’s total exports

+ Indonesia extended at least 6 tax incentives to year-end to support businesses, workers

- Thailand expands Covid-19 restrictions include travel curbs, mall closures and night time curfew after reported record cases

- Thailand more hotels may opt to sell their properties if stringent measures set for financial aid schemes

- Bank of Thailand: ceiling rate cut for consumer loans would not be a holistic solution to help ease debt burden of individual

- Myanmar’s electricity sector close to collapse as ppl refuse to pay their bill

+ Malaysia sets new target of fully vaccinating 100% of adult population by Oct

+ Malaysia to decide restriction relaxation for fully vaccinated individuals to be decided next week

+ Sg exports soared by 15.9% in Jun, driven by non-electronic exports, sharp increased from 8.6% expansion in May

+ Temasek reported 25% rise in its portfolio value to record S$381bn in year ended Mar 2021, biggest gain since 2010

+ Sg introducing differentiated Covid rules for people who are vaccinated

- Sg reported 88 new locally-transmitted Covid-19 cases on Sunday, highest in 11 mths

- Sg cuts dine-in group size, pivoted nightsports suspended amid spiked in Covid-19 cases due to KTV cluster

+ CBD grade A office rents grew 0.5% QoQ after 5 qtrs of decline, reaching S$9.60 psf in Q2: Cushman & Wakefield

- Sg saw 87.5% decrease in arrivals to just 2.7m visitors in 2020, nearly all coming from first two mths

+ Sg plans to become a key regional special coffee trading hub: SG Coffee Association

Contribution by Derek@valueinvestments chat group. Thank you.

Please follow us on telegram for the latest update on Lone Wolf investor by clicking on the link below

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for information only. Buyer beware,do you own due diligence.

Comments

Post a Comment