Wolf Money(world market review 8-14 Nov 2021)

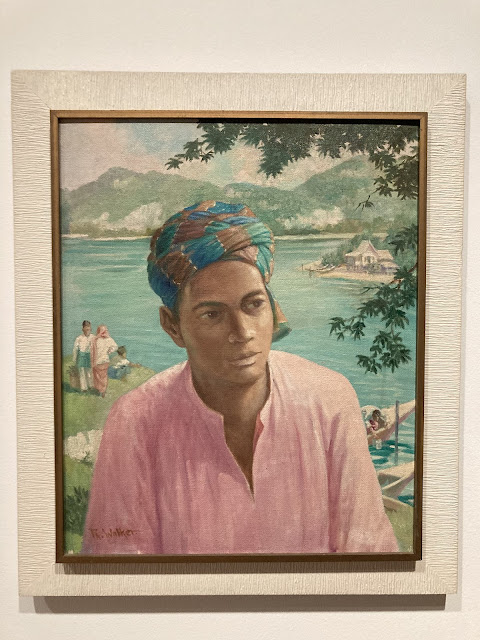

Richard Walker British 1895-1989

Hari Raya - Gathering at the Ferry

Collection of National Gallery Singapore

Market Summary 8-14 Nov 2021

🇺🇸 🇺🇸 🇺🇸 🇺🇸 🇺🇸

- US inflation surges to 30-year high in Oct, consumer prices jump 6.2% YoY

- US govt posted US$165bn budget deficit for Oct, 42% lower than US$284bn shortfall a year earlier

+ US social spending of US$1.75 trillion package may include a tax break apply to most millionaires

- US consumer confidence hits 10-year low in Nov amid rising inflation

+ Biden and Xi to meet on Tue via video link

+ US getting traction with China in Phase 1 deal talks: trade chief Tai

- Biden signed bill to tighten telecoms equipment oversight

+ Biden said chief executives of major US retailers assured him store shelves would be stocked in time for holidays

+ US eyes Jan rollout projects to counter China’s BRI, include vaccine manufacturing hub in Africa, renewal energy supplies

- Fed warned China’s real estate sector including Evergrande have the potential to impact US

- Republicans in Senate called for fresh Nord Stream 2 sanctions which Biden had waived earlier this year

+ US will open talks with Japan on import steel, aluminium tariffs

+ Elon Musk sold combined US$6.9bn worth of Tesla shares this week

+ Nasa, SpaceX launched 4 astronauts on flight to int’l space station

- Apple faces delivery delays amid chip, labour shortages

- Google lost its appeal against a US$2.8bn antitrust decision by EU

+ Disney to make technological leap into virtual reality world first imagined by science fiction writers: CEO

+ J&J to spin off consumer products and focus on pharmaceuticals

+ General Electric unveiled plans to spin off its healthcare, energy and aviation businesses into separate companies

+ Rivian shares soared from IPO, is now biggest US company by market value with no revenue

🇨🇳 🇨🇳 🇨🇳 🇨🇳 🇨🇳

- China’s PPI climbed 13.5% YoY vs 10.7% rise in Sept, at 25-year high: NBS

+ Beijing Stock Exchange to debut on Nov 15 with at least 81 listings

+ Yuan hits 5-year high as exports surge, likely to stay in near-record territory

- GZ court finds drugmaker Kangmei liable for losses incurred by >50,000 investors in its stock related to massive fraud

+ SZ court approved China’s first personal bankruptcy liquidation

+ China to improve links between digital yuan and payment apps

+ China’s imports of coal in Oct nearly doubled YoY as it turned to fossil fuel for surging energy prices

+ China will act to keep property market stable and prevent prices from rising rapidly: Central Bank

+ China Weighs Moderating Property Curbs to Help Troubled Developers Unload Assets

+ PBOC’s carbon-reducing lending program could unleash >US$63bn estimated to be released over next few years

+ China to offer path for economic recovery at APEC leaders’ meeting

+ China finalised 3-tranche bond deal worth €4bn

+ China state council think-tank met developers, banks in SZ: source

- China’s growth rate of imports from Australia declines for the first time in 2021

+ Ant Gp reshuffles consumer loan business to make it clear who’s doing the lending

+ China’s rare earth price exceeds historic high amid booming demand and tight supplies

+ China Int’l Import Expo (CIIE) wrapped up with projected purchases worth US$70.72bn

+ Geely to launch a high-end electric pickup truck

- Evergrande faces US$366m in interest payments before year’s end

+ China’s Oct mortgage lending jumps as restrictions ease

+ Chinese photovoltaic (PV) LONGi eyes setting up production bases in overseas, including India and US

+ Tencent posted decline in net profit in Q3 amid regulatory changes, unveiled 3 computer chips of its own design

+ Alibaba records US$84.54bn in orders in Singles Day, slowest ever sales growth

+ SMIC to triple production capacity amid domestic demand; Q3 revenue reaches record high of US$1.42bn

+ Didi to relaunch apps in China, anticipates probe will end soon

+ HK plans gradual reopening with China from Dec, global travel in mdi-2022

+ HK vaccine passport a future possibility: health chief

+ Richard Li’s FWD reportedly mulls to switch IPO to HK from NY

+ Taiwan’s exports rose for 16th straight mth in Oct to new high, outlook strong for next 6 mths

+ TSMC assured customer confidentiality in data submission to US govt

+ TSMC, Sony confirmed plans to build US$7bn chip factory in Japan with capacity to produce 45,000 12-inch wafers per mth

🌍 🇯🇵 🇷🇺 🇲🇽

+ Global chip sales rose 27% in Q3 YoY to US$145bn

+ Bitcoin price hits all-time high, total market cap of all crypto tokens approaching US$3 trillion

- Japan >50% of firms plan to pass or have passed on rising commodity costs to customers

+ Japan plans economic stimulus package worth US$350bn aimed at easing pain from pandemic

+ Toyota at full production in Japan, first time since May, plans to develop alternative fuels with other Japanese auto makers

+ Toshiba plans to split into 3 after wave of scandals

+ Russia’s oil production could once again reach record highs pre-Covid oil output levels

- Russia plans to tax crypto miners

- Mexico raises interest rates for the 4th consecutive time

🇪🇺 🇩🇪 🇬🇧 🇳🇱 🇦🇹

- European Parliament approved new rules to make MNCs and subsidiaries to stop dodging taxes

+ European Commission raises growth forecast for 19 countries, economy bouncing back from the worst

- European 6 firms said they were either reducing their exposure to vessels transport coal or considering doing so

- Eurozone industrial production down 0.2% in Sept

+ European natural gas prices plunged to Sept low on Russia boost

- Euro zone housing demand to persist, hitting poorer households: ECB

+ EU will allow clearing houses in London to continue serving customers in the bloc beyond next June that set to expire

- EU court upheld €2.4bn antitrust fine, the penalty was the first of 3 antitrust penalties

+ EU-UK entering new round of Brexit negotiations to prevent possible trade war

+ German govt could expect up to €10bn of additional income tax revenue through to 2025

- German exports fell 2nd consecutive mth in Sept, imports nearly stagnated

+ Germany’s listed largest companies post record profits despite supply chain crisis: EY

- UK faces slow growth, high inflation after pandemic and Brexit: NIESR

+ BoE likely to be the first major central bank to raise interest rates, probably in Dec: economists

+ BoE becomes first European Central Bank to green its corporate bond buying

- Netherlands to go into partial lockdown for at least 3 weeks after seeing record in daily Covid-19 cases

- Austria orders lockdown for those not vaccinated against COVID-19

🇮🇳 🇰🇷 🇮🇷

+ India’s annual retail inflation rose to 4.48% in Oct vs 4.35% in Sept YoY

+ India’s payment platform Paytm expected to raise US$2.5bn on IPO subscription, potential to be biggest in India’s history

- India’s current account deficit expected to hit 1.4% of GDP or US$45bn by March as crude soars: Barclays

+ Korean Air surprised the market by posting highest Q3 operating profit in 5 years, boosted by strong demand for cargo traffic

+ Iran called for talks with Germany, France, UK to revive nuclear deal progressive

🇮🇩 🇹🇭 🇵🇭 🇲🇾 🇸🇬

+ South East Asia’s digital economy to top US$175bn in 2021: report

+ Indonesia consumer confidence index recorded 113.4 in Oct at level not seen since March 2020

+ Indonesia secured US$46.6bn investment commitment after Jokowi’s trip to UAE

+ Indonesia govt to inject US$4.2bn into sovereign wealth fund to finance infrastructure, tourism, tech projects

- Indonesia gvot will inject US$300m into Jakarta-Bandung high-speed railway on project that far outgrown its original budget

- Garuda has negative equity of US$2.8bn burden increases by US$100–US$150m per mth

+ Jakarta needs private investors to expand MRT, LRT worth nearly US$6bn

+ Indonesia to have US$2bn investment from Dubai’s AKS to develop sugar factory to help reliance on sugar import

- Thailand central bank expects spike in NPLs after banks relaxed debt assistance measures

- Thailand’s nightlife venues across the country will remain shut for at least 2 more mths

+ Thailand plans to complete feasibility study for first 16.5km section of Grey Line electric monorail project

+ Duterte’s Daughter to run for Vice President in 2022 election

- Malaysia’s economy contracted in Q3, shrinking 4.5% as Covid-19 curbs hit

- Malaysia’s public healthcare expenditure to increase considerably in short term despite reforms: report

- Malaysia no major mobile carriers have agreed to use govt’s 5G network yet due to transparency and pricing issues

+ Malaysia-Indonesia plan to allow fully-vaccinated travellers to fly between the 2 nations

+ Malaysia consortium of mid-tier firms hopes govt can ratify CPTPP by Dec 2021 to remain competitive

+ Sg alternative assets post strong 2020 growth in Sg asset management industry: MAS

+ Sg remained top destination in SEA for startup investments, raised S$11.2bn in first 9 mths, more than twice whole 2020

+ Sg condo resale prices up for 15th straight mth but with lower volume in Oct

+ Sg-Malaysia to start VTLs for quarantine-free air travel from Nov 29

+ Sg plans to introduce a year-long programme in 2022 to use sustainable aviation fuel at its airport

+ China-SG trade in services innovation forum in Shanghai to discuss new path for high-level opening up service

- SIA cuts Q2 loss to S$428m helped by VTLs double revenue to S$1.5bn, currently has 79% of fleet ready

- Grab’s reported US$88m in revenue in Q3, down 26% YoY, hit from virus curbs

- Crypto exchange Huobi Global to close Singapore accounts by end-March 2022

Contribution by Derek@valueinvestments chat group. Thank you.

Please follow us on telegram for the latest update on Lone Wolf Investor by clicking on the link below

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for information only. Buyer beware,do you own due diligence.

Comments

Post a Comment