Wolf Money(Cash, Federal Reserve and Me)

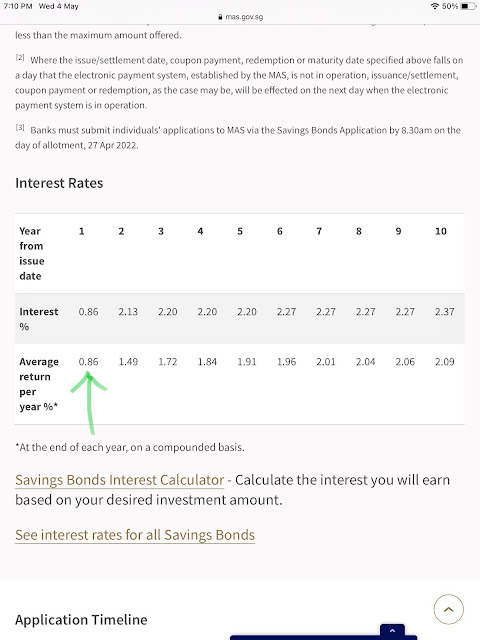

In my April month end update,I mention about yield on cash is likely gain strength over the course of next 12 months. Singapore Saving Bond(SSB) just announced the June issue. The front end of the yield curve had spiked. First year interest on SSB is at 1.43% vs 0.86% of last month issue. An increase of 66% from last month issue. It is a big increase. To put it in simple explanation, a 10k May SSB will yield $86 p.a vs June issue of $143 p.a. The amount will be huge if you add another zero to the vested amount. As risk free rate spike, better days are ahead for saver. SSB can be an useful tool for people looking to park their short term capital with higher interest return compare to commercial bank FD rates. Best of all, one is not subject to liquidity risk or capital loss as redemption can be done at par within 1 month notice with very low credit risk(Singapore Ah Gong AAA rated).

The Federal Reserve hiked rate 0.5% yesterday to try slow the march of inflation. Fed fund currently stand at 0.75%-1%. They will continue to increase interest rate to tame the inflation dragon. Another 0.5% June hike is on the card. US Mortgage application had started to slow drastically. Last month mortgage application was down 50 percent. The implication is a slow down in the housing market due to few buyers financing a new home purchase which affect a host of other housing related industries like home builders, banks and retail . It is still too early to tell if the ghost of 2008 GFC is back. Businesses rolling on short term bank loan might face trouble getting an extension from banks at a lower rate. High yield index is showing initial sign of early stress. Interest rate risk can manifest into liquidity and credit risk very quickly. Companies with strong balance sheet can better weather the difficult environment.

On a personal note, I had redeemed my mortgage. I am expecting banks to start sending out snail mail to inform their customers on their mortgage rate increase. ARM(adjusted rate mortgage) or flexi rate mortgage in Singapore context are likely to be most affected. Some banks had stopped offering fixed rate mortgage in anticipation of higher rate. Given the inflation pressure on household expenses, rising interest rate add an additional layer of expense to already high cost of living of ordinary Singaporean. Fixing mortgage rate can be a way to have certainty of monthly mortgage payment and piece of mind. I am also looking around for the good fixed deposit rate, transferring fund from low yielding account to higher interest saving account is another option. Cutting back on discretionary spending is another way to stretch that dollar. 7 dollars Starbucks mocha are within my cross hair for cost cut(I used to spend 500 bucks a month on Starbucks alone during my broking days which wasn’t necessary).Toast-Box and Yakun here I come, more home cooked meal less restaurant food. Lazada and Shopee shopping are addictive. They cling on to your wallet like a tick which refuse to go away. I am confidence I will be saving much more by deleting the apps. Coin drop is another painless way to save. There are plenty of ways to save money, what’s yours? Do share your good money saving tips via comments section. God bless.

Please follow us on telegram for the latest update on Lone Wolf investor by clicking on the link below

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for education only. Buyer beware,do you own due diligence.

Comments

Post a Comment