Wolf Money(portfolio update end June 2022)long post!

Portfolio as at end of June

1.) Cash

2.) Singapore Medical Group(SMG)

3.) Comfortdelgro Corporation(CDG)

Commentary

Sell away in May and go away in June. The market jingle had its way after all. For the past two months if you had flown out to another country, away from the stock market for a well deserved holiday, you would have easily save 15% on your investment capital. The market had gone Gaga, no amount of “hold my hand” can calm the market jitters. The closest thing of me taking to the sky was a trip to the cinema for a Top Gun sequel. Made popular by Tom Cruise, the first instalment in ‘86 was the very movie that made him the legendary A lister of Hollywood. In 1986, major events grabbing the headline beside the exploding stardom of Tom Cruise included The explosion of the space shuttle, Challenger, after 73 seconds of takeoff and the explosion of Chernobyl nuclear power plant. Coincidentally North Korea is likely to conduct nuclear test after a 5 years break, I hope Tom Cruise is not leading his Wingman for an explosive secret mission to DPRK nuclear facility😅 and Dow Jones had its biggest correction in its history up till 1986 due to fear of big interest rate hike which is similar to the current situation. History had a way of repeating itself. My best guess the market is not out of the woods, there might be pockets of green shoot on some days before resuming downtrend.

Singapore Medical Group

Singapore Medical Group is slightly weaker for the month of June thou no harm was done to the overall health of Lone Wolf Fund. LWF ytd was up 9% with cash dominating my portfolio. Ground check shown medical tourists are back in town. Specialist clinics especially those in Orchard road area had trouble handling the sudden surge in patients load. Indonesian, Vietnamese and Malaysian are the biggest medical tourists coming into Singapore. Mt. E are fully booked almost on a daily basis. I look forward to knowing more about Singapore Medical Group business in their upcoming half year result in August.

Cash

As for cash or rainy day fund, I am likely to adopt a 3-6 months dollar cost(yield) averaging on Singapore Saving Bond starting next month where yield is likely to average 3% or above over a 10 years holding period. I estimate one can only get about 15k-20k of SSB per issue due to high demand from yield starved savers jumping onto the bandwagon. The maximum holding amount for SSB is 200k with 100k maximum per issue. 3% AAA instrument is decent but is unlikely to make anyone filthy rich.

Comfortdelgro Corporation

There is some addition into my portfolio, it must have come as a surprise to most people including myself given how bearish I am on the market. I bought a small position in Comfortdelgro Corporation. It is one of more divisive company among the local investment community, most people I had spoken doesn’t have a favourable impression of the company. Oil price high lah! Taxi business no good lah! were the two common negative views on Comfortdelgro, I would suggest anyone who is interested in the company to read Comfortdelgro annual report to fully understand their business. It is truly a global business. I had a peek at their 1Q number, the number looks good even without government subsidies. Freedom day which the government lifted most of covid restriction in month of April had yet to factor into 1Q result.

I can see the office crowd heading back to office given the sardine like squeeze on Mrt during morning peak and the long waiting time for my kopi at Ya Kun during lunch hour. I can be more or less certain the passengers number will improved substantially from the month of May to end of Dec this year given the low base. Even thou the bus contracting model doesn’t give the operator much revenue boost but they do get a bump up in numbers just by increasing frequency of services.

(In May, rail ridership went up 57% from 621k to 974k year on year)

Passengers number is currently at 81% of pre covid level in 2019. I estimate operating leverage will set in around 870m revenue per quarter where any increase in the top line, a large percentage of revenue will flow through directly towards the bottom line. Cash generation from business is rock solid, couple with a net cash position of more than 610m in the latest quarter, a rare occurrence for a public transport company. The cash is likely to continue to roll in at a rate of 150m annually after dividend and capex. The taxi business is no longer a drag as there are less taxis on the street and people can’t find enough cab on the street. The company had right size it’s taxi fleet to less than 9k. I see the Taxis number at a steady state with further decline to be slow or unlikely. I also find Grab and Gojek pricing to be on par or even more expensive than a cab ride in some instances. The dynamic of migrating towards cheaper service is likely to perk up demand for taxi. Tourists arrival also help CDG business. DTL(Downtown Line) new rail financing framework stop the bleeding at DTL which had been loss making since 2017.

The company had diversify into other businesses like train management service in New Zealand and EV leasing/charging. Comfortdelgro is likely to be the one of the biggest player in EV charging(think in form of a new “petrol stations” business). The government will be announcing the winner(s) of the 12k EV chargers installation at HDB & public carparks by the 4Q this year. CDG is in contention for some contract win. The payback of AC charger is attractive. I estimated base on my source, one charger will be able to achieve break even within 12 months at 70 percent utilisation rate. The key to the business is to secure as many locations due to URA or LTA limiting EV lots in each carparks to 1 percent of the total lots be converted into EV charging currently. EV charging is also a very localised business, one wouldn’t be driving to another charger away from your home just to save a few cents per kWh and spend a couple of hours waiting. Furthermore CDG buys electricity from SP at 20c per kWh and sell to user at 50-55c per kWh. The margin is actually quite decent at 6c-10c. The EV charging business can potentially be another anchor to CDG business. For eg 6,000 chargers roll out will cost around 25m which is small capex by CDG standard for a leadership position in a new business. It can also be deployed in short notice. 479 chargers tender which they won last year can potentially made 1.5-2m. The government is looking to install another 40,000 chargers by 2030(latest figure is 60,000 by 2030). The profit potential for CDG is huge.

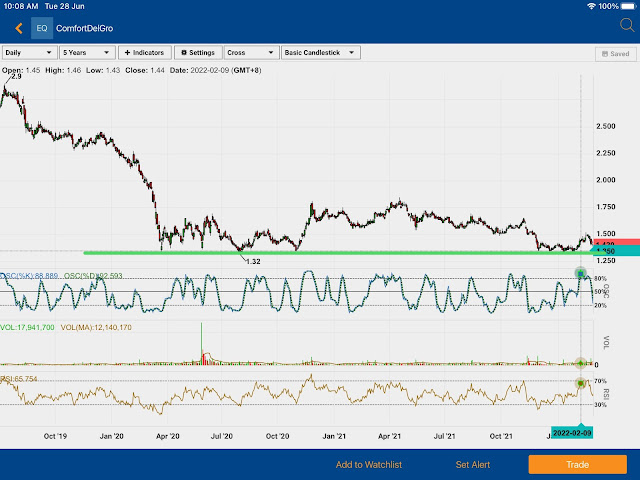

They had also strengthened their present in Australia by buying family owned bus companies. A revival of CDG Aust IPO can’t be rule out in the future which is worth the ballpark of $1.2B. Is this a classic case where operationally they are doing better now compare to those covid period but the market had decided to give them a lower valuation and share price? The share is trading close to 10 years low. Of course the oil price do have an impact on CDG, some net off can be seen from increase use of public transportation, contracting model, yearly transport fare adjustment and fuel indexing formula. A formula is in place if profitability of public transport companies suffered due to high fuel price, government will be chipping in to make up the shortfall. The new EV business will also get a boost from high oil price. CDG is one of the safe bet on reopening. Major support can be seen at $1.32-$1.35 level. Dividend is likely to be around 6-7c or 4.5%-5% yield base on a 70 percent payout this year. I am forecasting CDG to make a range of between 9-10c eps in FY2022. They will be coming out with half yearly result by mid of August. Btw, I had a “Contra fling” with CDG last year at close to $1.60 given the poorer operating environment last year, now the market had priced it lower with reopening firing in all cylinders. Did I get it wrong or the market? 🤔. CDG is trading just above 1x book value with about 29c of net cash per share . Major risks involved prolong high oil price and reimposing covid lockdown in major operating markets.

(5 years chart suggest there are probably some support within the range of $1.32-1.35)

I am taking baby steps back into the market over the course of next 6-9 months, no Big Bang theory yet. CDG position is going against conventional wisdom of high oil price environment, a contrarian bet which required some miracle. Miracle did happened in ‘86 World Cup Maradona Hand of god. Can Taxi lead me to highway of glory or low road to “Danger Zone”? Engaging in stock market activity is after all a “risky business”. No risk no gain. Till we meet again. God bless 🙏

Please follow us on telegram for the latest update on Lone Wolf investor by clicking on the link below

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for education only. Buyer beware,do you own due diligence.

Comments

Post a Comment