Wolf Money(book recommendation)

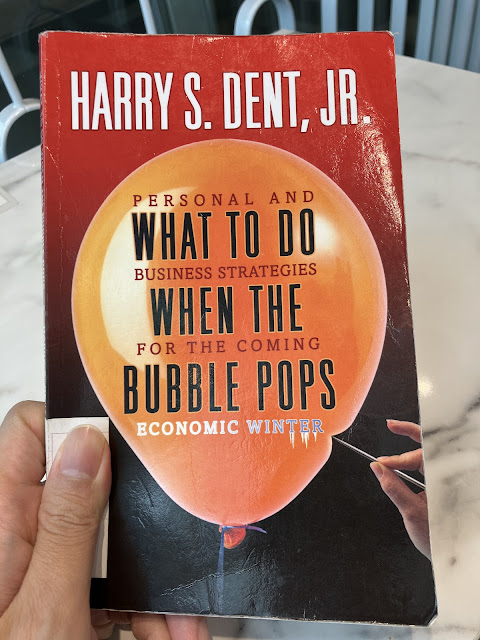

‘What To Do When The Bubble Pops’ personal and business strategies for the coming economic winter by Harry S. Dent, Jr was the second book by the author that I had picked up and review. The first been ‘The Sale of a Lifetime’. The latest book had a similar sounding theme to it. Market is crashing, you should run for the exit with godspeed!. The author is the bearer of bad news, any optimist will turned pessimistic after reading his book. I always like to read opposing views(the bearish and the bullish) to be able to come out with my own opinion on the current state of the market.

Although there are a couple of flaws in his assessment(one been Singapore property had drop substantially in the year 2020 which is not the case, instead of dropping, 2020 turnout to be the start of a strong run up in property price in Singapore). I still find it worthy of a read since it is a wafer thin book with only 135 pages. His in-depth study of cradle to grave cycle, Geopolitical cycle are well researched and articulated.

There are a few industries that he like and dislike. He advised readers to take advantage of the changing demographics and spending trends.

1.) Discretionary Healthcare for example in area of cosmetic surgery to wellness(vitamins, diet and weight loss) are likely to do well.

2.) Travel Industry due to retirees having more time and money to travel. Cruise industry will benefit greatly from the spending.

3.) Healthcare, life and financial insurance will do well even with a downturn as more people start planning for retirement due to growing awareness on the need for retirement planning early.

4.) Convenience stores and drugstores are likely to experience a surge in demand due to ageing population, seniors are likely to opt for the nearest location to get their daily essentials.

5.) Housing is likely to experience a dip in demand as population drop due to inability for some countries to regenerate their population.

6.) Landscaping, home improvement, eldercare, funeral service and nursing home will be in great demand.

The author summaries the follow strategies for personal finance during economic downturn and market crashes. Sell stocks, hide the cash in AAA instruments like government treasury, buy US dollars or dollar index etf to bet a rising USD trend. Sell non strategic discretionary real estate. He expect deflation to cause most asset and commodities to fall. Paying off highest interest loan like credit card. After every carnage, when there is blood on the street, it is time to get out of safe instruments and start buying quality stocks and assets. The above strategy is sound and proven. The only concern is always implementation. The right implementation comes from having good knowledge and battle field experience. Reading Lone Wolf Investor blog may help too😁. For your information, Harry predicted the next boom to come around 2023-2026. Till the good time return, buckle up and sit tight. The book goes on to Lone Wolf recommendation for its easy to read and sound strategy.

Please follow us on telegram for the latest update on Lone Wolf investor by clicking on the link below

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for information only. Buyer beware,do you own due diligence.

Comments

Post a Comment