Wolf Money(world market review 27 June - 02 July 2022)

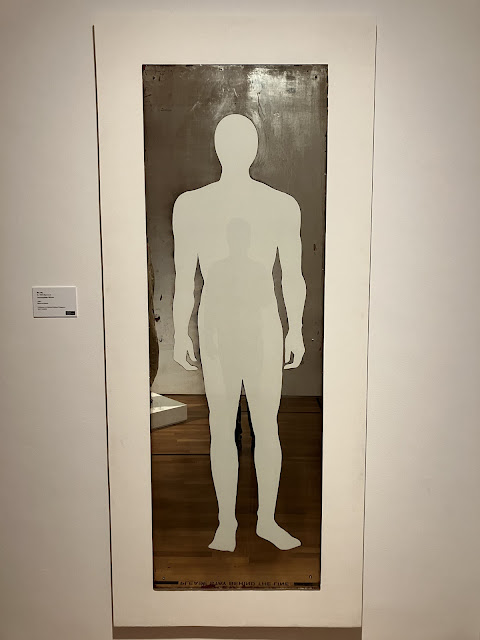

Po Po Myanmar 1957

Incomplete Mirror circa 1991

Collection of National Gallery Singapore

Market Summary 27 Jun – 02 Jul 2022

🇺🇸 🇺🇸 🇺🇸 🇺🇸 🇺🇸

- S&P posted worst first half since 1970, benchmark down by 21%

- US manufacturing activity slows to 2-year low in June

- US consumer confidence index fell to 98.7, down from 103.2 in May

- US core PCE deflator slowed from 4.9% to 4.7% YoY vs consensus forecast of 4.8%

- US new vehicles sales tumbled >21% in Q2 YoY as global chip shortage continued to cause production problems

- US mortgage lenders, refinancing firms, real-estate brokers may lay off thousands of employees in coming mths

+ US mortgage rates fall for the first time in 4 weeks on economy uncertainty, 30-year fixed rates fell by 11 basis pts

- US construction spending fell in May as single-family home building stalled, construction spending slipped 0.1%

- US prohibits Russian gold imports, UK, Canada and Japan reportedly joined in ban

- Boeing said “disappointing that geopolitical differences continue to constrain US aircraft export” after China top 3 airlines buy nearly 300 Airbus planes

+ US offers to boost pilot pay 17% by end 2024

- US hundreds of flights axed as it kicks off long holiday weekend

+ Shell, Exxon join study to build China’s first major carbon storage project

- Tesla laid off about 200 of workers on its Autopilot team, shuttered a California facility

- Tesla’s delivered 17.9% fewer EVs in Q2 from previous qtr, disrupted by China’s Covid-19 shutdown

+ GM surpassed Toyota in Q2 US car sales

- US quality of vehicles sold fell to 36-year low as supply, labour shortages continued: consultant J.D Power

- US continued to see newspapers die at the rate of 2 per week; country had 6377 newspapers end of May

🇨🇳 🇨🇳 🇨🇳 🇨🇳 🇨🇳

+ China’s June manufacturing PMI at 50.2, back to expansion range, up from 49.6 in May: NBS

+ China’s private Caixin/Markit Manufacturing PMI rebounded to 51.7 in June, highest since last June

+ China’s manufacturing activity expanded at its fastest in 13 mths in June, supported by strong rebound in output

+ China’s non-manufacturing PMI rebounded to 54.7 in June from 47.8 in May supported by more construction activity

+ Xi arrived in HK by train to inspect and attend HK’s 25th anniversary return to China

+ People’s Bank of China announced new funding measures to boost infrastructure, support regional projects

+ China shortens Covid quarantine time for int’l travellers to 7 days from 14, reducing at-home health monitoring to 3 days

+ China to extend yuan trading hours as part of internationalisation push

+ China to give subsidies to domestic oil refining firms to safeguard stable supplies of processed oil and reduce operating costs

+ Shanghai province raises annual coal output by 107m tons to 1.3bn to ensure domestic energy supply

+ China to further extend tariff exemptions for some goods imported from US until mid-Feb 2023

+ China’s firms shifting to new overseas markets such as Switzerland to expand capital-funding channels

+ China to raise US$45bn through financial bond issuance to replenish capital for major projects, boost employment

+ China had issued US$180.4bn in local govt bonds in May

+ China’s first root-community of desktop operating system, Openkylin, makes debut, to boost development of open source ecosystem, help realise independent and innovative development of software industry

+ Beijing’s economic output will exceed 5 trillion yuan (US$745bn) in next 5 years: Beijing’s Party Secretary

+ China Rare Earth Gp announced established an int’l trade firm to deepen integration

+ China 3 state-owned airlines to purchase 292 Airbus aircraft valued at around US$37bn in total

+ China’s air ticket booking rise 300% past week amid surging demand, relaxed travel restrictions

- Great Wall Motor shelved plans to invest US$1bn in India, laid off all workers after failing to obtain regulatory approvals

+ China Railway built a track change station at China-Laos railway, to attract >300,000 tons of goods from Thailand per year

- China property developer Shimao has missed the interest and principal payment of US$1bn offshore bond

+ China new home price rises at slightly faster pace in June: private survey

- Evergrande faces creditor petition in HK for liquidation

- ByteDance, Tencent about to implement fresh job cuts

+ BYD on the cusp of entering the trillion-yuan-market-cap club

+ JDcom founder cashes nearly US$1bn from the e-commerce company

+ China several large firms lining up list in HKEX in H2

- HK high-end housing rental becomes the only market in 10 major cities to suffer drops as expats leave due to Covid curbs

+ HK could cut hotel quarantine to 5 days, with another 2 in home isolation

🇯🇵 🇷🇺 🇨🇦 🇧🇷 🌏

- Japan’s May industrial output at 88.3, steepest fall in 2 years

- Japanese firms expect inflation to stay around 2% target for years to come, disagrees with BOJ’s view: survey

- Japan’s Kirin plans to sell its stake in Myanmar Brewery to JV partner

- Nissan to suspend production in Russia for 6 mths

- Russia’s inflation in 2022 seen at 14.5%, to expect more rate cuts

- Russia seized control of Sakhalin gas project partly owned by Shell and 2 Japanese firms

- Gazprom cancelled 2021 dividends, first such move since 1998, shares tumbled 30%

+ Canada’s economy to top G7 on high oil, crop prices

+ Brazil’s trade surplus reached US$8.8bn in June

- Global factory growth stalled in June due to higher prices and weaker economic outlook

- G7 reached an agreement to set a price cap on Russian oil exports: Politico

+ G7 states say do not intend to apply sanctions on Russian food and agricultural products

- Crypto lender Voyager Digital suspends withdrawals, deposits

🇪🇺 🇩🇪 🇬🇧 🇫🇷 🇹🇷

- Eurozone annual inflation accelerated to another record at 8.6% in June

+ EU prepares emergency plan to do without Russian energy

- Eurozone manufacturing production fell in June, first since initial wave of pandemic 2 years ago: PMI

- Eurozone is headed toward “stagflation”: UBS

+ Eurozone unemployment reached new all-time low at 6.6% despite economic slowdown

- EU needs at least 3 years to replace Russian gas: Fitch

+ ECB to buy bonds from Italy, Spain, Portugal, Greece with proceeds from maturing German, French, Dutch to cap spreads

- Germany manufacturing PMI, account for 1/5 of economy, fell to 52 in June from 54.8 in May

- German 1 in 4 fears losing job due to Ukraine crisis

- Germany to impose levy on all gas consumers to help suppliers grappling with soaring gas import prices

- Germany’s chemical giant BASF may shut down its biggest facility due to reduced Russian energy supply

- Commerzbank had reduced workforce by 7000, plans to reach agreements with rest of staff intends to lay off by end year

+ Audi to start build first NEV manufacturing base in China, annual output of >150,000 NEVs expected

+ Mercedes-Benz to invest €2bn in luxury EVs in Europe

+ Volkswagen to narrow EV gap between Tesla in terms of production and sales by end 2022

- UK’s Q1 current account deficit ballooned to 51.7bn pounds or 8.35 of GDP, biggest shortfall in records back to 1955

- French inflation in June hit record of 6.5%: preliminary figures

- France wants sanctioned Iranian and Venezuelan crude to return to global market

+ Turkey reaches NATO deal with Finland and Sweden

🇦🇺 🇮🇳 🇰🇷 🇸🇦 🇮🇷 🇱🇰

- Australia’s first online-only bank to shut down, returning deposits, selling mortgage book after failing to raise sufficient funds

- India’s factory output at 9-mth low in June as inflation dampen demand and output

- India to tax windfall gains accruing to oil companies from soaring energy prices

- South Korea’s trade deficit may continue, harming the economy as it relies heavily on imports of raw materials

- Hyundai Motor’s union votes to strike first time in 4 yrs after stalled negotiations for higher wages

+ Saudi Arabis Public Investment Fund holding talks for Aston Martin stake

+ Iran applies to join BRICS group of emerging countries

- Sri Lanka has stopped gasoline sales amid an energy crisis

🇮🇩 🇹🇭 🇱🇦 🇲🇾 🇸🇬

- Indonesia inflation rose 4.35% YoY in June, driven by food prices

+ Indonesia likely to book 2022 fiscal of US$68.2bn, or 3.92% of GDP, lower than previous outlook 4.5% due to strong revenue

+ Indonesia’s 6-mth long tax amnesty has uncovered nearly US$40bn of unreported assets, earned govt US$4bn extra tax revenue

+ Indonesia govt to start construction of new capital Nusantara in August

+ Indonesia-China state-owned CAMC signed dam building contract worth US$290m

+ Indonesia looks to raise palm oil export quota

+ Thailand’s May exports rose faster than expected 10.5% YoY, weak baht a boost

- Thai Airways Int’l submitted new debt rehabilitation plan following a better-than-expected recovery

+ Thailand plans to extend property support measures to help boost recovery of the industry

+ Laos plans to issue regulations for offshore online gambling businesses

+ Malaysia govt looking into ways to address rising prices of goods: PM

+ Malaysia surpassed target of 2m tourist arrivals, with new target of 4.5m set

- Sg home loan rates hit new high of 3.08% with latest move by UOB

+ Sg expects more IPO activity in H2 in firms manage to find realistic valuations acceptable at right price to investors: Deloitte

+ Sg to launch >6.36 hectares of industrial land supply for H2

+ Sg private home prices up by 3.2% in Q2: URA, HDB resale price index rises 2.6% QoQ: OrangeTee

+ Sg is the most sustainable place for real estate in APAC: Knight frank

- Sg electricity tariffs up by 8.1% from previous qtr or 2.21 cents per kilowatt-hr

+ Sg cruise industry set to return to pre-pandemic levels between 2023-2024: STB

+ Sg and Malaysia to deepen cooperation in digital and green economy

- Sg based crypto fund Three Arrows Capital files for bankruptcy in US

Contribution by Derek@valueinvestments chat group. Thank you.

Please follow us on telegram for the latest update on Lone Wolf investor by clicking on the link below

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for education only. Buyer beware,do you own due diligence.

Comments

Post a Comment