Wolf Money(book recommendation)

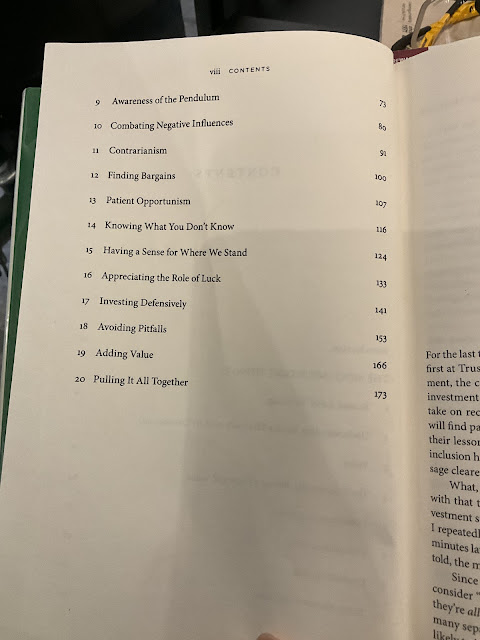

The book “The Most Important Thing” by Howard Marks of Oaktree Investment is an investment classic, a quintessential read if you are in the financial market. I rated it one of the most important book for any serious investor. This is by far the best book I had read this year. The book consolidated some of the past memos written by Howard Marks which had an impressive record of achieving 19% yearly return since 1995. Very few fund managers can proclaimed to be able to beat the market for that long duration. I have trouble trying to write this book review as there are many important topics which will required intensive reading and writing. It is impossible to write a book review 7 pages long without boring my reader. Today I will just touch on one important subject for what Howard Marks described as the importance of 2nd-level thinking. Good 2nd-level thinking can help investors achieve superior return.

What is 2nd-level thinking? For example of first level thinker “This is a good company, BUY the stock”

Second level thinker “This is a good company but everyone thinks it is a great but it is not, it is overpriced SELL IT!”

Another example of first level thinking “The outlook of economy is bad, rising inflation so dump the stock”

Second level thinking “ The outlook is bad and everyone is panic selling. It is a BUY market”.

To summarise Marks’s point, be a contrarian. It is easy to earn a market average return by investing into an index fund or index ETF. It takes a person with the special second level of thinking to earn higher than market return which we all hope to achieve as an active investors or else we had already surrendered out autonomy to Index ETF by now. He described first level thinker to be simplistic and superficial, just about everyone can do it. Second level thinker is deep, complex and sometimes convoluted. A checklist of what a brain of a second level thinker had to go through before an investment is made are as follow.

1.) What is the range of likely future outcome?

2.) Which outcome do I think will occur?

3.) What’s the probability of a good outcome?

4.) What does the consensus think?

5.) Does my expectation differ from general consensus?

6.) How is current price of asset comport with consensus vs mine?

7.) Had the consensus incorporated their bullish and bearish into the price of asset?

8.) What will happen to the asset price if the consensus is right and I am wrong or the other way round?

In order to achieve superior return, one must hold non consensus views regarding value, they have to be accurate and that’s is not easy by any measure. There are plenty of thought provoking topics which made this book a joy to read. I do suggest taking in the knowledge slowly. Read and digest Marks’s thought process. This is a legit book that is worth spending the weekend reading. The book goes onto Lone Wolf highly recommended list for its common sense and sometimes the uncommon takes on key issues surrounding a successful investors without the financial jargon. In a life of an investor, you just need to make a few good investments and avoid making too many mistakes, a simple and sometimes difficult task to accomplish. The most important message coming out of the book is to be a defensive investor, when the downside is quantified, the upside will take care of itself.

Please follow us on telegram for the latest update on Lone Wolf investor by clicking on the link below

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for information only. Buyer beware,do you own due diligence.

Comments

Post a Comment