Wolf Money(book recommendation)

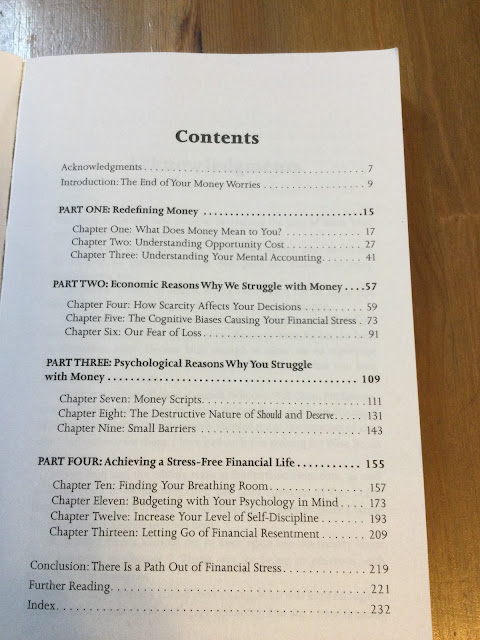

I haven’t been catching up on my reading over the past 2 weeks due to the need to organise renovation workflow for my house. What I did managed was to complete the book by Emily Guy Birken titled “End Financial Stress Now”. The book is timely read given the rising mortgage rate and a corrective financial market which may bring about greater financial stress. The book taught the reader the concept of money and how to improve one financial well-being.

The book start out by asking what does money mean to you and why is it important. In his views.

Money is respect-Dressing professionally does give a sense of affluent. People tend to give better service when one drive a nice car into a hotel.

Money is security-Money provide a sense of security as living without money can be terrifying.

Money is freedom-Money does give one the freedom to pursue the lifestyle and interest which they may desired.

Money is success-Money can be seen as a basic indicator for success even thou one can be miserable in their job.

Money is love-People view the ability to provide as love. Love equal money but one can’t fill a hungry stomach with only love.

Money is time-With money it free you up with more time to do the things you always wanted to do.

The author went into the subject of free. Sometime free is not necessary “free”. I can related this from my personal experience of receiving an ink jet printer for free but having to pay for expensive ink cartridges. Now one could sent an email without the need to print any documents. Another example of free can be found in “free” online games where the developers charge the players a ridiculous amount of money for buying weapon or magic box when playing that “free” game so as to progress to the next level. The scenario also caused one to lose out on opportunity cost where money and time spent on gaming could be put into more productive income generating opportunities. Free shipping provided by online shopping is a powerful buying psychological. One maybe spending more on things that one doesn’t need just to qualify for free shipping. Free can be expensive in someway. You would be able to learn about sunk cost bias, heuristic bias and others interesting bias which we sometime subconsciously deployed when we spend our money.

The core idea for improving financial well-being is to resist the temptation to spend. It involved a lot of self discipline and will power. Keeping will power on top of your game can be exhausting. There are ways to distract yourself from spending money with money one doesn’t have and can’t afford, just think of the reasons why you’re trying to improve your financial situation. It can help motivate one to stay on track. Other example like having a snack before going for grocery shopping help cut down spending on unnecessary items is worth trying.

The point I find it interesting in the book is the need to get rid of financial resentment. Financial resentment is an ongoing feeling of anger and disappointment because of a real or perceived money related injustice from one personal experience. Holding on financial resentment can distorted and self sabotage financial well-being. Resentment can cause corrosive and in process damaged one financial peace. When one is at peace with yourself, you are at peace with your wallet. I like to summarise in my own words, admire the person who are doing better financially than yourself, learn the right thing from them. You can’t hate a rich person if you aspire to be one. It is better to handle problems associated with having too much money than those problems associated with having too little. The book goes onto Lone Wolf recommendation list for its simple concept and pleasant read.

Please follow us on telegram for the latest update on Lone Wolf investor by clicking on the link below

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for education only. Buyer beware,do you own due diligence.

Comments

Post a Comment