Wolf Money(world market review 13-19 Feb 2023)

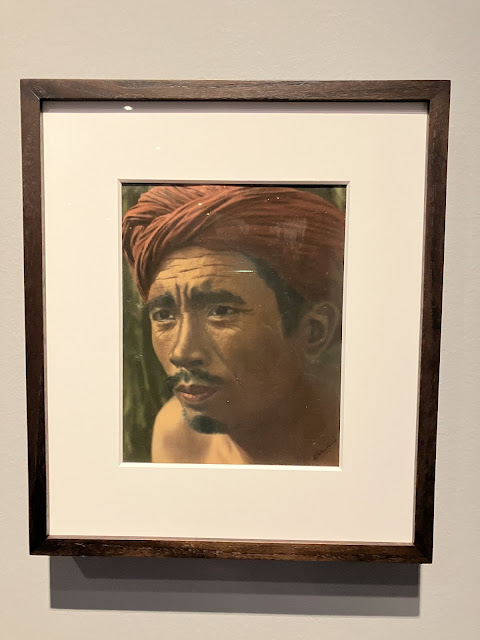

Eduardo Masferré Philippines 1909-1995

Man with Turban circa 1953

Collection of National Gallery Singapore

Market Summary 13-19 Feb 2023

🇺🇸 🇺🇸 🇺🇸 🇺🇸 🇺🇸

- US inflation rose 6.4% in Jan YoY, price pressures remain

+ US retail sales post biggest jump nearly 2 years of 3% in Jan after 2 straight monthly declines

- US manufacturing activity falling as businesses and households pull back spending

+ US import prices dropped for 7th straight mth in Jan amid declining costs for energy products, annual increase smallest in 2 yrs

+ US producer prices rise 0.7% in Jan on monthly basis

+ US jobless claims fell 1000 last week to 183,000 from 195,000 previous week, 5th straight week under 200,000

- US more Fed officials signalling interest rates need to go higher in order to successfully squash inflation

- US could face debt-cap crisis this summer without deal: CBO

- US shortages in labour supply likely to continue: Fed’s Barkin

- US and China diplomats communicating, but not militaries: White House

- US sending Pentagon official to Taiwan soon: FT

- US could sanction more banks with links to Russia and step-up enforcement against any dogging existing rules

- Binance moved >US$400m from US partner to firm managed by CEO Zhao

- Biden administration reviewing US$200m grant earmarked for lithium-ion battery maker Microvast due to tie to China

- Tesla to recall 362,000 US vehicles on full self-driving software

- Apple begun laying off contractors, appears to be a quiet move to slash costs: sources

- Meta hinting that more workers will resign from the company in coming weeks: WSJ

+ Boeing offers CEO US$5.3m incentive to stay through recovery

+ Lockheed Martin won initial US Navy contract worth US$1.1bn

+ Broadcom, VMware agreed to extend date of their planned merger by 12 mths

- Ford to cut 3800 jobs in Europe, mostly in Germany, UK

+ Berkshire slashed TSMC and some banks’ shares in Q4, while buying another 20.8, Apple shares worth US$3.2bn to 5.8% stake

- US charges Terra founder Do Kwon with fraud

🇨🇳 🇨🇳 🇨🇳 🇨🇳 🇨🇳

+ China regulator announced detailed regulations for across-the-board registration-based IPOs, effective immediately

+ Chinese firms speed up Swiss listings with 36 in pipeline: market data

+ PBOC ramps with record cash injection with ¥835bn via 7-day reserve repurchase contracts, resulted net injection of ¥632bn

- China sanctions Lockheed Martin, Raytheon for allegedly providing Taiwan with weapons

+ China’s outward direct investment (ODI) hits US$146.5bn in 2022, while overseas M&A picked up

+ China estimate nearly US$700bn of mortgages, close to 1/8 outstanding total have been prepaid since early last year, when banks started lower borrowing rates

+ China’s solar exports soar 80% to record US$51.3bn in 2022 despite trade frictions and rising competition

+ China’s renewable energy capacity overtakes coal for first time last year; accounted 47.3% of total vs coal 43.8%

- China’s mobile phone shipments stood at 271.5m in 2022, down 22.6% YoY: CAICT

+ China’s recovery biggest uncertainty for oil market: IEA

+ China and 5 Central Asian countries hold first-ever forum on industry investment cooperation

- China’s video game industry sales down 10.3% to US$39bn in 2022, first drop in 5 years, total users down 0.33% to 644m

+ China officials arrived in Taiwan on first visit in 3 years since pandemic began, to attend cultural event

+ China sees 4.73bn passenger trips during Spring Festiva travel rush

+ China to accelerate negotiations on version 3.0 of China-ASEAN FTA

- Tencent abandoning plans to venture into virtual reality hardware as metaverse bet falters: sources

- Foxconn signed US$62.5m lease on 45 hectares industrial park land, to establish new factory in Vietnam

🇯🇵 🇷🇺 🇦🇷 🇪🇨 🌏

+ Japan’s economy grew 0.2% in Q4 vs previous qtr or 0.6% at annual pace as tourism returns

- Japan posted largest-ever trade deficit of ¥3.5 trillion in Jan, roughly 1.6-flod increase YoY

+ Japan to launch pilot programme in April to test use of digital yen

- Honda and Nissan Motor sales in China plunged 56.2% and 64.4 respectively after falling behind on EVs

- Japan’s 8 major automakers unions pressed for highest-level wage raises in years to offset impact of high inflation

- Russia will respond if EU decides to confiscate its frozen assets: Minister

+ Putin: Gas demand will continue to be crucial resource regardless of attempts to hamper it’s exports

- Argentina saw its annual inflation hit 98.8%

+ Ecuador and China conclude FTA negotiation, both sides to sign the deal soonest

- IMF: energy, high-tech decoupling estimated to cause 1.2% of global GDP losses

+ G20 finance and central bank chiefs to meet in India next week to discuss rising debt, regulation of cryptocurrencies and global slowdown

- Bitcoin rallies to 6-mth high, jumped past US$24,000

🇪🇺 🇩🇪 🇬🇧 🇫🇷 🇨🇭 🇮🇪 🇵🇹 🇹🇷 🇧🇬

- EU will ban new sales of fossil fuel cars, slash truck and bus emissions from 2035

+ Eurozone’s current account surplus widen in Dec of surplus €15.90bn as cheaper energy lowered import bill

+ EU scrapped plan to sanction against Russian nuclear sector as Hungary didn’t let it through

- EU to force banks to reveal Russian assets: Bloomberg

- EU and Russia trade turnover fell by 1/3 in Apr-Dec 2022

+ EU to phase out Covid tests for travellers from China

- Germany producer prices up 17.8% in Jan YoY, index down 1% vs previous mth

+ German insurance giant Allianz reported record results for 2022; net profit at €6.7bn, up 2% YoY

+ Mercedes-Benz reported revenue of €150bn in full fiscal 2022, up by 12%

+ Commerzbank to rejoin DAX index, will replace Linde

- UK’s Jan inflation at 10.1% annually, lowest reading since Sept

+ France President met China top diplomat Wang Yi in Paris on strengthening bilateral cooperation

+ Hermes sales surged 23% in Q4 to record €11.6bn for 2022, up from €8.98bn the previous year; despite China disruption

+ Switzerland does not plan to confiscate private Russian assets frozen in Swiss banks: Justice Ministry

- Swiss citizens likely to vote in future referendum on keeping cash, campaigners wary of digital money in favour of cash in constitution

- Ireland scraps its Immigration Investor Program (IIP) to non-EU nationals due to overwhelming applications from China

- Portugal to end issuing “golden visas” to rich foreign investors to tackle lack of affordable housing

- Turkiye direct cost from earthquake damage could be amount to US$25bn: JPMorgan

- Turkiye-Syria earthquake death toll passes 45,000, many still missing in flattened apartments

- Bulgaria postpone target date for adopting euro to 2025 after failing to meet listed criteria

🇮🇳 🇰🇷 🇶🇦

+ India’s Russian oil imports surged to record in Jan

- South Korea’s President called on banks, telecoms to ease living costs

- Korean Airlines bid for Asiana Airlines may hurt competition; EU antitrust opened full-scale investigation into the deal

+ Qatari consortium made bid to buy 100% of Manchester United

🇮🇩 🇹🇭 🇲🇾 🇸🇬

+ Indonesia extended trade surplus in 33 straight mths of US$3.87bn in Jan, biggest for non-oil and gas exports China amounting to US$5.25bn or 25% of overall exports

+ Bank Indonesia kept its key interest rate unchanged for the first time over 6 mths at 5.75% in Jan

+ Thailand PM to dissolve parliament before term ends next mth

- Thai govt’s planning unit downgraded economic growth forecast to 2.7-3.7% in 2023 from 3-4% earlier

- Malaysia’s national debt passes RM1.5 trillion mark

- Malaysia’s rising level of national debt should not be taken lightly, can no longer rely on oil to keep economy afloat: FM

+ Malaysia govt truly walking its policy talk for EV industry through various measures: Minister

- Malaysia foreign investors continued to dump Malaysian equities for 5th consecutive week with net selling of RM512.3m

- Sg NODX dropped 25% in Jan, down for 4th consecutive mth amid weak global demand

- Sg will implement global minimum corporate tax of 15% in 2025

- Sg introduced higher marginal Buyer’s Stamp Duty (BSD) for higher-value residential and non-residential properties

+ Sg int’l visitor arrivals rose to 921,530 in Jan, setting new record since onset of pandemic

- Sg FY2022 fiscal deficit revised lower to S$2bn from earlier estimate of S$3bn

- Sg govt expects a deficit of S$0.4bn or 0.1% of GDP in FY2023

+ Sg fintech funding hit 3-year high in 2022, deal value rose 22% to US$4.1bn; 250 deals in M&A, PE and VC vs US$3.1bn in 2021

+DBS posted record net profit of S$8.19bn for FY2022, 20% higher than S$6.81bn previous year

- Google cuts estimated 190 employees in Singapore, part of its 12,000 worldwide layoffs

Contribution by Derek@valueinvestments chat group. Thank you.

Please follow us on telegram for the latest update on Lone Wolf investor by clicking on the link below

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for education only. Buyer beware,do you own due diligence.

Comments

Post a Comment