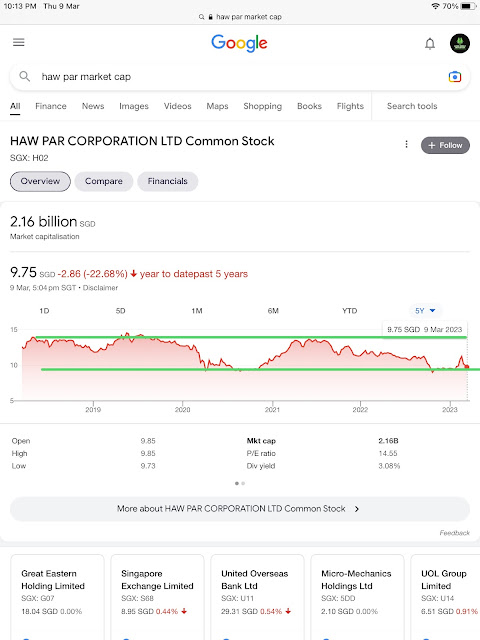

Wolf Money(Haw Par Corporation)

I have taken a position in Haw Par Corp(HPC). I am sure a lot of value investors would have long drawn to this deep value company. Haw Par Corp has three core businesses, one part healthcare, one part investment and one part leisure. The two main businesses which generate the most profit for the group are healthcare and investment.

Healthcare

Tiger balm brand is very well established in Asia, very popular with tourists buying back as a gift for their friends and relatives when they travel to Singapore. The Singapore heritage brand was founded by the Aw senior in 1870s. The healthcare unit generates a steady profit for the company in the range of 30-40m a year.

Investments

The investments portion mainly comprises a 4.4% stake in UOB and a 8.5% stake in UOL are the prime cuts of the “mix grill”. Dividends from both companies amounting to 104m making up most of the HPC’s 148m profit in FY 2022. The market value of UOB share alone is worth around $10 per Haw Par Corp share equaling to the whole market capitalisation of Haw Par Corp. If Haw Par ever had intention of selling UOB shares, the shareholders of Haw Par will get the rest of the businesses for free which make up of 3 leasehold office properties, 8.5% stake in UOL shares(468m), the healthcare business and 600m cash around $2.7 net cash per share. The reported NAV of $16 made up of highly liquid assets comprises of marketable securities, cash and treasury bills. The share is trading at only 0.6x price to book. How did a healthcare company got involved in UOB share, the initial shares in UOB was part of the deal for UOB to acquired Chung Khiaw Bank which was then under Haw Par Brothers. The story of Haw Par is one of fascination akin to an old version of the “Crazy rich asian” movie. This company has to be one of the most undervalue company listed on SGX. It is one of the rare net net listco in Singapore with strong fundamental.

Below is a link to the Haw Par story

https://www.ricemedia.co/forgotten-history-haw-par-villa/

Please follow us on telegram for the latest update on Lone Wolf investor by clicking on the link below

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for education only. Buyer beware,do you own due diligence.

it just dropped $1 below my buying price, luckily i have only 1 lot...hahaha

ReplyDeleteYou get use to it pretty soon 😆 best of luck tiger cub

Delete