Wolf Money(world market review 8-14 May 2023)

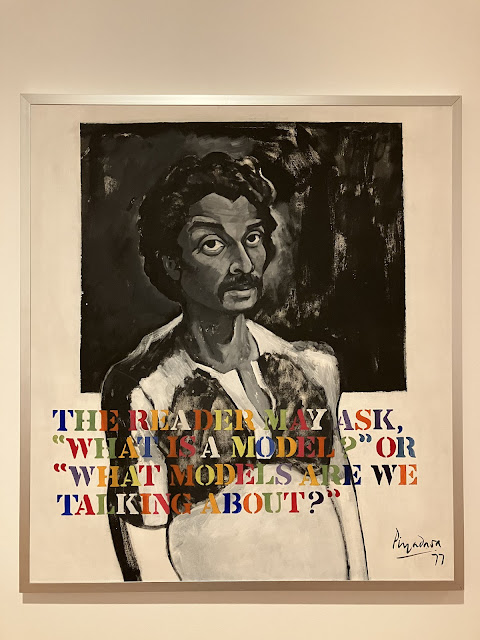

Redza Piyadasa Malaysia 1939-2007

Portrait of the Artist as a Model circa 1977

Collection of National Gallery Singapore

Market Summary 8-14 May 2023

🇺🇸 🇺🇸 🇺🇸 🇺🇸 🇺🇸

- US consumer sentiment slumped to 6-mth low in May on debt ceiling debacle that could trigger recession

+ US bank deposit up in early May to US$17.16 trillion, from lowest level in near 2 years, bank lending little changed at record level

+ Yellen expects US regulators to be open to mergers among midsize banks

+ Biden nominated Philip Jefferson as Fed vice chair

- Chia-US trade slide 4.2% in Jan-Apr

+ US extending exclusions from tariffs for 77 of 91 Chinese medical product import categories related to Covid-19

- US approved first transfer of confiscated Russian funds to Ukraine

- US ARC Automotive rejected regulator’s request demanded the recall of 67m air bag inflators

- Pfizer CEO calls US drug price plan ‘negotiation with a gun to yr head’

- Binance US explores ways to reduce founder Zhao’s majority stake

- Binance pulls out of Canada amid new crypto regulations

- GM recalling nearly 1m US vehicles for air bag defect

+ Musk named former NBCUniversal advertising chief Linda Yaccarino as Twitter’s new CEO

+ Netflix plans to cut spending by US$300m this year

🇨🇳 🇨🇳 🇨🇳 🇨🇳 🇨🇳

+ China’s CPI in Apr rose 0.1% YoY, lowest rate since Feb 2021, cooling from 0.7% annual gain in Mar: NBS

+ China trade sector grew 8.9% in April in yuan’s terms

+ China’s export up 8.5% in Apr in unexpected climb

- China new bank loans tumbled far more sharply than expected in April

+ China recorded 5.8% growth in foreign trade over first 4 mths: custom data

- China’s local municipalities with all 31 apart from Shanghai reporting deficits in 2022

+ China list population policy improvement as one of nation’s top priorities to tackle demographic change

- China launched investigation into global consulting firm Capvision in latest national security probe

+ China’s special envoy to visit Ukraine and related countries to promote political solution to crisis

- China’s investment in Europe fell to 10-year low in 2022 amid increasing scrutiny: new report showed

+ China experimental ultra-high speed maglev train with maximum speed >1000 km/h will be built in Heilongjiang

- China traders look at alternatives to Canadian goods amid political tensions after diplomat expulsion

+ China to strength food emergency security system in responding to external uncertainties

- China top corn importer could cancel more purchases of grain from US in shift to cheaper Brazil cargoes

+ China approved import of qualified French pork, will create fast track channel for French agricultural and food imports

- Chinese civil aviation lost US$31bn in 2022: data

+ Shanghai Cooperation Organisation {SCO} member states working on use of national currencies in mutual settlement

+ China’s foreign minister to visit Australia in July

- Oppo to shut down chip design unit as smartphone sales slump

🇯🇵 🇷🇺 🇧🇷 🇦🇷 🇪🇨 🌎

+ Japan 62.1% of firms raised or plan to up base pay in fiscal 2023 vs 38.7% previous year

+ Nissan reported 7-fold surge Jan-Mar profit, Honda’s profit fiscal year ended in Mar down 1.7%, Toyota down 14% fiscal year

- Japan’s current account surplus in fiscal 2022 shrank 54% YoY to ¥9.23 trillion, the lowest level since fiscal 2014

- SoftBank vision fund loses US$32bn on weak startup values

- Russia’s budget gap surged in first 4 mths, surpassing govt’s full-year target as energy revenues dropped, spending up

- Russian car dealerships seeking US$110m in compensation from Renault due to losses incurred of departure of the country

+ Russia increased supply oil products to Latin America in response to Western price caps and embargoes

+ Russia China bilateral trade stood at US$73.15bn in first 4 mths, surging 41.3% YoY

+ Russian may export more agricultural products such as wheat and barley to China amid push for land grain corridor

+ Brazil’s Suzano SA, world’s largest producer of hardwood pulp may accept yuan for exports to China

- Argentina’s posted 8.4% monthly inflation and annual inflation rate soared to 108.8% in Apr

+ Ecuador and China signed FTA after a year of negotiations

- Index of global food costs rose in Apr for the first time in a year, price index averaged 127.2 pts vs 126.5 in Mar

- High fuel prices and recovering demand ends era of low-cost travel: TUI

🇪🇺 🇩🇪 🇬🇧 🇫🇷 🇮🇹 🇪🇸 🇨🇭 🇭🇺 🇱🇮

- EU to take anti-Russia sanctions global, targets include firm in China, HK, UAE and Central Asia: Bloomberg

- EU named 7 Chinese firms in new package of restrictions for trade with Russia: FT

+ EU >100 firms expected to participate in joint LNG purchases

- EU ministers backed plan to reduce economic reliance on China

+ Germany given final approval to allow China state-run firm COSCO to buy a major stake in Hamburg Port

- UK GDP fell by 0.3% in Mar, grew by 0.1% in Q1 over strong performance in Jan

- UK’s PM risks missing his goal of halving inflation this year: NIESR

- BOE raised key interest by a qtr percentage pt to 4.5%, highest level since 2008

- UK households been hit with record jump in food prices due to decades-high inflation: British Retail Consortium

+ UK transatlantic travel projected to hit 99% of pre-pandemic levels in May

+ UK aims to draw up to US$63bn fund to back its startups

+ London’s super-prime ppty market had it strongest year since 2016, total £3.1bn spent on 161 super-prime properties in Q1

+ France to increase enforcement of taxation controls and to toughen penalties for tax evasion, focus on combating major fraud

+ France’s Orano to JV with China’s XTC New Energy with investment of €1.5bn in the battery sector in Northern France

- Italy 35% of households experienced worsening financial condition last year due to rising inflation

- Italy planning to hold talks with China on potentially quitting B&R infrastructure and investment project: FT

- Spain’s prolonged drought have caused olive oil prices surged to record levels

- Switzerland revealed assets and reserves belonging to Bank of Russian worth US$8.3bn are currently held in the country

+ Hungary would oppose any attempts to impose restrictions on Russia’s nuclear sector by EU: FM

+ Liechtenstein is considering accepting Bitcoin as payment for state services: PM

🇦🇺 🇮🇳 🇦🇪

+ Australia on track for first annual budget surplus since global financial crisis in 2008: Treasurer

+ Australia’s trade minister returns from China trip with agreements to step up dialouge

+ Sensex ends the week at 5-mth high

+ India foreign inflows into real estate jump threefold in 6 years: Colliers

+ Adani Gp seeks to issue shares for the first time since short selling attack

+ Emirates swung to record annual profit of US$2.9bn in fiscal year ended 31 Mar on strong travel demand

🇮🇩 🇹🇭 🇻🇳 🇲🇾 🇸🇬

+ Indonesia retailer projected to maintain sales momentum even after fasting mth and holidays: Bank Indonesia data

- Indonesians million at risk of falling back into poverty: World Bank

+ Thailand’s consumer confidence index (CCI) at 38-mth high in Apr at 55 vs 53.8 in Mar: UTCC

+ Thai Airways net profit in Q1 reached 12.5bn baht, expected to earn at least 130bn baht in revenue this year

+ Vietnam EV arm VinFast inked US$23bn SPAC deal with Black Space Acquisition, would be largest-ever US listing from SEA

+ Vietnam’s first electric-only taxi company plans to rollout 20,000 vehicles in the country and expand to Asia

+ Malaysia’s GDP grew more than expected at 5.6% YoY in Q1

+ Malaysia’s current account balance at RM4.3bn in Q1 or 1% of GDP vs 5.9% of GDP in previous qtr

+ Malaysia property market remained robust despite rise OPR by 25bps to 3%: REHDA

+ Sg MAS gold reserves up 45% in 3 mths, added 69 tonnes, first increase in its gold reserves since Jun 2021

+ Sg construction of JB-SG RTS link has reached 50% mark: Minister

+ DBS plans to boost its presence in Dubai to better access other markets and source business in ME and Africa

+ Genting Singapore Q1 earnings >triple to S$129.2m amid travel recovery

Contribution by Derek@valueinvestments chat group. Thank you

Please consider follow us on telegram for the latest update on Lone Wolf investor by clicking on the link below. No form filling, no payment required, no collection of data, no data mining, no hard selling, no obligation.

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for education only. Buyer beware,do you own due diligence.

Comments

Post a Comment