Wolf Money(world market review 31 Jul-4 Aug 2023)

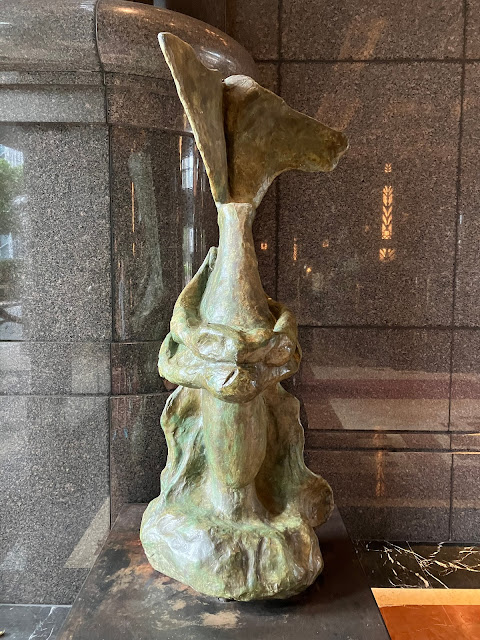

Salvador Dali Spain 1904-1989

Warrior Head Circa 1982

Collection of Parkview Square

Market Summary 31 Jul-6 Aug 2023

🇺🇸 🇺🇸 🇺🇸 🇺🇸 🇺🇸

- Fitch cuts US long-term rating to AA+ from AAA, citing debt ceiling issue

- White House and Treasury Dept raised objections to decision by Fitch to downrank long-term US rating

+ US labour productivity jumped by most since 2020 at 3.7% annual rate in Q2, helping offset rising labour cost

- US Treasury Dept announced increase in issuance of longer-term bonds in coming mths

- US 10-year borrowing costs rise to 9-mth high

- US mortgage rate on 30-year home ticked up to 6.9% vs 4.99% a year ago; 15-year fixed rate at 6.25% vs 4.26% a year ago

- US banks reported tighter credit standards, weaker loan demand from both businesses and consumers in Q2: Fed survey

+ US private sector added 324,000 jobs in Jul, above expectations: ADP

+ US weekly jobless claims rose slightly of 6000 last week to adjusted 227,000, layoffs dropped to 11-mth low in July

- US employment totalled 9.58m for Jun vs 9.62m in May, lowest level of openings since Apr 2021

- US Kansas state’s regulators shut down Heartland Tri-State Bank due to insolvency and appointed FDIC as receiver

+ BofA CEO reversed prediction for a recession in coming mths due to strength in jobs market and robust consumer spending

- US accused China of trying to use status as developing country to seek profit and avoid responsibility

- US construction spending rose 0.5% in Jun, data for May was revised higher to 1.1% instead of 0.9%

+ Intel partnered with China Nanshan district govt and local tech firms with chip innovation centre

+ Berkshire Hathaway Q2 net income hit US$35.91bn

+ Apple net profit rose 2.3% to $19.9bn, earnings per share jumped 5% to $1.26, ahead of forecasts for $1.20.

- Tesla China’s Jul sales declined 31% compared to Jun

+ Ford’s US sales rose nearly 6% in Jul, however EVs are still lagging

- Trump appears in court to face charges of election subversion efforts

🇨🇳 🇨🇳 🇨🇳 🇨🇳 🇨🇳

- China’s official manufacturing PMI rose to 49.3 in Jul from 49 in Jun, remained in contraction for 4th straight mth

- Chian’s non-manufacturing gauge fell to 51.5 from 53.2; measures business sentiment in services and construction sectors

+ Caixin/S&P Global services PMI rose to 54.1 in Jul, up from 53.9 in Jun, expanded for 7th straight mth

+ China central bank vowed to use multiple policy tools to ensure steady economic recovery in H2

+ China to continue support the stable and healthy growth of the property market amid overall economic slowdown

- China’s Jul new property sales by biggest developers plunged by >33%

+ China vows further mortgage easing to support housing, plans to implement precise and differentiated housing credit policies

+ China’s biggest cities Shanghai, Beijing, Shenzhen and Guangzhou expected to relax purchasing restrictions

- China’s export controls on gallium and germanium take effect 1st Aug, may first hit entities from countries cracked on China

+ China will launch its first 28-nanometer homegrown lithography machine at year-end: report

+ China introduced 26 measures to support high-quality economic development; include boosting auto consumption

+ China extends small-business tax relief for 4 more years; easing VAT, income tax rates and other business costs

+ China stepping up support for micro-sized, medium-sized enterprises, making easier and cheaper to get financing

+ China finance ministry issued bonds worth ¥12bn in HK

- China provincial govt audits reveal spending vouchers have not worked well

- China planning a year-long nationwide crackdown on corruption in pharmaceutical sector

- China’s medical exports tumble as world moves on from Covid

+ China total 39 companies made their debut or re-entered Fortune Global 500 list; CATL and Meituan appeared for the 1st time

- China proposes to limit children’s smartphone time to maximum of 2hrs a day

+ Huawei was the only company among top smartphone vendors to record double-digit shipment growth in domestic market

- China records heaviest rainfall in at least 140 years, causing severe flooding and at least 20 deaths

+ BYD hires 30,000 college graduates so far this year: sources

+ Luckin coffee beats Starbucks in China for the 1st time, posts 2nd qtr sales of US$862m vs Starbucks US$822m in China

- Shimao Gp shares plunged >67% by most on record or US$1.1bn in market cap as trading resumed after 16 mths

- CK Assets’ new home launched selling at lowest prices in 7 years, about 20% below market rates

🇯🇵 🇷🇺 🇦🇷 🌍

- Japan to expand anti-Russia sanctions to cover wider range of goods, including metals, chemicals, industrial gear

+ Toyota to ram up EV car push in China with R&D revamp

- Russian grain exports hit record high in Jul, shipments reached 5.68m tons

+ Gazprom set new record for daily gas deliveries to China through Power of Siberia mega pipeline

+ Bitcoin mining machines have been flowing into Russia: CoinDesk

+ Argentina taps China currency swap line to help repay IMF loan

+ Global shipping costs jumped by most in >2 years after 16-mth slump in ocean freight

🇩🇪 🇬🇧

- Germany HCOB final PMI for manufacturing , accounts for 1/5 of economy fell to 38.8 in Jul from 40.6 in Jun, 6 consecutive mthly decline

- German seasonally-adjusted unemployment rate at 5.6% in Jul vs 5.7% in Jun, at 2.617m

+ German agricultural machinery manufacturer CLAAS to continue business with Russia

- BoE raises interest rates to 5.25%, bringing borrowing costs to 15-year high, hints borrowing rates will stay high

- UK manufacturing PMI fell to 45.3 in Jul from 46.5 in Jun, fell at fastest pace in 7 mths

- UK house prices fell by most since 2009 in the 12 mths to July, averagely down 3.8%

🇦🇺 🇸🇦 🇮🇷

- Australia Senate committee recommended ban on TikTok from federal govt devices be extended to WeChat

+ India considers scrapping wheat import tax to cool prices

+ Saudi n China in talks for ETF cross-listings to bolster financial ties

- Saudi Arabis’s GDP expended annual 1.1% in Q2, down from 3.8% in previous qtr and 11.2% same period 2022

- Saudi to extend unilateral production cut of 1m barrels of oil a day through end of Sept

+ Iran boosts oil production to 5 years high to 3.1m bpd

🇮🇩 🇹🇭 🇲🇾 🇸🇬

+ Indonesia’s new capital construction had reached almost 30% of its target: Ministry

+ Indonesia inflation drops to almost below 3% in Jul, at 3.08%

+ Thailand to remain open to Chinese investors, build resilient supply chain

+ Malaysia working on plans to build Sabah, Sarawak rail link to Indonesia’s new capital

+ Malaysia: Infineon Tech will invest up to €5bn over next 5 years to build world’s largest 200mm SIC power fab plant

- Sg PMI inched up 0.1 pt in Jul to 49.8

- Sg retail sales rose 1.1%YoY on jun, vs May’s 1.8% growth

+ Sg aviation sector to fill >4300 jobs in coming years, at 95% of pre-Covid level

Contribution by Derek@valueinvestments chat group. Thank you

Please follow us on telegram for the latest update on Lone Wolf investor by clicking on the link below. No form filling, no payment required, no collection of data, no data mining, no hard selling, no obligation.

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for education only. Buyer beware,do you own due diligence.

Comments

Post a Comment