Wolf Money(Valuetronics 1H FY2024 result)

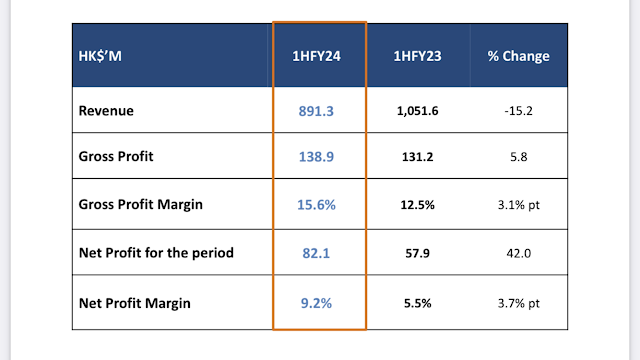

Valuetronics blow passed my expectation. Profit went up 42%. Margin expanded and cash had risen to SGD 48c per share which is around 87% of the current market cap. The improvement in earnings was due to what I expected, interest income. Interest income accounts for over 30% of their earning. If there is any imperfection, the revenue is abit light due to slower demand from customers. The company is also proposing an additional interim special dividend of HKD 4c on top of normal dividend HKD 4c. More review at the end of month update. Thank you. God bless.

Please consider following us on telegram for the latest update on Lone Wolf investor by clicking on the link below. No form filling, no payment required, no collection of data, no data mining, no hard selling, no obligation.

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for education only. Buyer beware,do you own due diligence.

Comments

Post a Comment