Wolf Money(Portfolio update for end Feb 2024)

Money comes, money goes

The trade war between the US and China will be a multi-decade competition. Hong Kong, unfortunately, is caught between a hard rock and a hard place. Given the city’s reliance on foreign financial institutions setting up shop and to create jobs for the locals. The capital flight out of HK after the security law was introduced causes hardship for Hong Kongers. Western MNCs have been leaving the city in large numbers, affecting office leasing and their local economy. The trade war has a more direct impact on HK than in any other cities in China. HK has become the collateral damage to the struggle between the two world powers.

The falling property and stock market adds more hardship for everyday workers. The two dish rice or commonly known as mixed vegetable rice in Singapore, has become popular in HK due to its low price. The current downturn in HK is the worst I have seen since the 1997 Asian Financial Crisis. Without any doubt in my mind, the people of Hong Kong with their resourcefulness and entrepreneurial spirit, will bounce back stronger.

In the most unexpected scenario, Singapore is one of the beneficiary of the trade war. Capital and human resources have been flowing into our country from China, HK and Western MNCs. It also explains the better than expected performance of our property market and the persistent high cost of living. Our property is one of the rare market around the world that has defied gravity given the high borrowing rate globally. Capital that helps to create jobs and increase local expertise should be encouraged but those rent seekers driving up property price and COE should be considered with care, as those capital are known to be fair weather, dashing for the exit at first the sight of any economic weakness. It happened in Dubai previously in 2009 and now HK. Hong Kong and Dubai situations must, and can draw a lesson for Singapore. Like anything that works in a cycle summarised by a Chinese proverb “Man can’t always be fortunate, nor can flower last forever”.

rén wú qīan rì hǎo, huā wú bǎi rì hóng

人 无 千 日 好, 花 无 百 日 红

Lone Wolf Fund(LWF)

Portfolio as at end of Feb 2024

1.) Cash

2.) China Petroleum & Chemical Corp (Sinopec) (HKEx: 0386)

4.) Ping An Insurance (HKEx : 2318)

Commentary

The US market is on a tear. The bulls are concentrated in a few big mega stocks which drove the S&P 500 passed the 5000 mark. The Singapore market, as usual, was underwhelming. Our index was down 11 points for the month. I have been saying this all along, our market is sick, and it needs all the help it can get. Will there be a Singapore market a decade from now? The old timers investors that invest in Singapore equity will eventually pass on to see the great Lord and the current generation of young investors have shown a disproportionate interest for other markets(US,Bitcoins and HKEx) than our own. We had already loss substantial interest from fund institutions due to the minuscule weightage in the MSCI index. We could barely afford the loss of retail interest in our market. A task force should convene as soon as possible to find tangible and verifiable solutions to the problem. The stock market generates a lot of high-paying white collar jobs from brokers, underwriters, auditors, lawyers, backroom operation. All those jobs are at risk, including those at our stock exchange.

On a portfolio front, Lone Wolf Fund has gone back to Chinese equities, with back to back purchase of Sinopec and Ping An Insurance within the last couple of months. It is my intention to steer clear of US trade sanctionable sectors in China. Tech, for obvious reasons is at the crosshairs of US red list. Lone Wolf Fund was up 1.5% for Feb, ytd gain stands at 3% (excluding dividend and cash yield) due to better performance of Chinese companies within my portfolio. The Chinese market is on a bullish run. The regulator has sent out a clear message, don’t short the market. A host of restrictions on short selling have been initiated. The Chinese have become a long-only market. 😄

I made my first sale of the year in Valuetronics and SBS . Valuetronics achieved a total return of more than 16% in 4 months. I guess the exit price could have been better but the overall lack of liquidity in SGX is a problem. One can only buy a stock that is grossly undervalued(-2 standard deviation) and hoping the stock will rise to an undervalued price(-1 standard deviation) , making the difference between grossly undervalued and undervalued price. It is unlikely most stocks will ever achieve fair value in our market due to the current poor state of interest. It is hard to comprehend the harsh reality, but I have to accept the limitations of the Singapore market.

I sold my position in SBS Transit not because the company lacks the fundamentals. In contrast, I feel SBS transit might report better earning in q1 2024 with 3 months of full fare increases incorporated into their numbers this quarter. The company experienced a 1.6% growth in profit for FY23. Lone Wolf Fund walked away with a small gain from the sale. LWF holds no share in the company.

The sale was due largely to the dividend differential compare with other higher dividend yielding companies. There are many dividend stocks yielding more than 6% vs SBS low 4%. SBS Transit didn’t include a special dividend in their latest result in conjunction with their golden jubilee in FY2023. It was the best opportunity to reward your shareholders. There was no increase to their dividend payout ratio, to be inline with CDG and sister company, Vicom 70% payout. SBS Transit continues to have a low payout ratio of 50%. It was disappointing, but I have to accept the company difficulty in rewarding shareholders. The company has a net cash amounting to $371m or $1.19 per share. I reckon SBS Transit should be nationalised or privatised for the public good. I speculate the board might have to contend with public perception on transport operator paying larger dividend after yearly fare hike. In all honesty, there is no valid reason for an asset light business to hoard cash. For those unfamiliar to the public transport contracting model. LTA fund the buses, trains and infrastructure investments and public transport operators like SBS Transit are awarded contracts to run the service with little or no revenue and trade receivable risks. Capex spending is moderately low.

A merger with SMRT, taking the company out of public eyes should be considered. SBS Transit might want to rethink their status as a public listed company. Even those local listed companies with better growth and dividend yield have failed to attract Singaporean investors’ interest. Can a low growth and low yielding company attract investors’ interest? I don’t know. 2c worth. As usual, no menace in my opinion and they are not directed at anyone. I am stating the facts from what I had seen in our market. Trying to satisfy both the public stakeholders’ and shareholders’ interest is a tough balancing act for the company.

The sale of SBS share was a difficult decision given my son’s love for buses and trains. We have wonderful memories of travelling on public transport. I always have a soft spot for the company. It is what it is, life goes on as usual. Capital will be redeployed. God bless the good people at SBS Transit and other transport operators especially those frontline staffs for their selfless service to the commuters. I can not emphasise enough the importance of their role in serving the public. Thank you for the safe journey.🙏

China Petroleum and Chemical Corp (Sinopec)

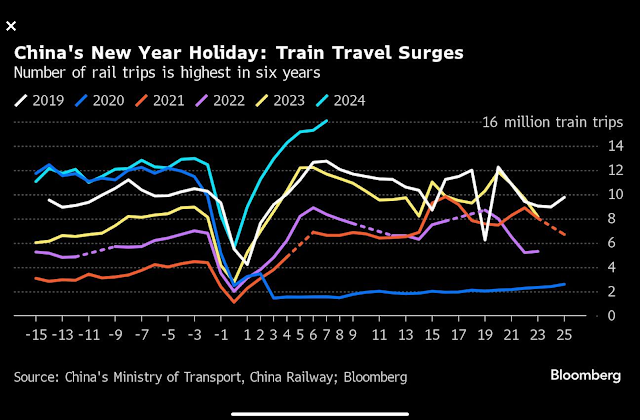

The main reason for my latest purchase in Sinopec was due to valuation. The Chinese oil major is attractively priced at only 1/3 book value and 2/3 P/E ratio to its Western counterparts (e.g Exxon Mobil). Sinopec H share has a gross yield in excess of 9.5% at the time of writing. I had rolled over some of my proceeds from the sale of Valuetronics to Sinopec Corp. Valuetronics was sold to free up capital due to my reluctance to put in fresh capital. The bullish US market is making me uneasy. Golden wisdom that never falls out of fashion “there is always a bear hiding among the bulls”. I am guarded against a big pull back in US market. The second reason for Valuetronics sale, Sinopec yield is much higher than Valuetronics. Third, I felt Sinopec might have a longer runway given the recovery of the Chinese economy. The recent CNY travel hit a record high. Given the Chinese renew appetite for travel. Demand for fuel is likely to increase. Sinopec’s business is heavy on refineries. I suspect the refining margin is better than their competitors due to cheap input stock from Russian oil. The discount given by the Russian producers to the Chinese refiner is rumoured to be within the range of 10-20%. One scenario is for the Chinese to refine Russian oil and sell it as Chinese oil to countries which have a trade embargo with Russia. India was reported to be selling refined oil using Russian crude to EU customers.

Ping An Insurance

The shares continued its rebound in Feb. Most Chinese companies, including Ping An will be reporting their final year results in March. I will analyze the company result in great detail. Questions pending to the housing and stock market crisis, hopefully could get enough airtime. There are market talks about China state fund buying index etf which effectively help to perk up the price of red chip companies.

Boustead Singapore

The delisting of Boustead Project was finally done on the 9th Feb. Boustead Project walked into the history textbook as a listed company finally. Boustead Singapore has a 99.45% ownership of the subsidiary. I am cautiously optimistic about the contribution by BPL. The asset stabilisation of the Bideford property is into its first year. I expect bigger contributions from BPL in the second half of FY 2024. There was a rare open market purchased by Mr. Wong FF on the 28th of Feb at an average price of 87.5c.

Cash

There was an increase in cash due to sales of Valuetronics and SBS Transit with net off from Sinopec purchase. I did not roll over my lower yield SSBs this month.

Summary

To be honest, I get uneasy when the US market is on steroids. I am watching my exposure closely even though I have no US investment. If the US sneezes, the rest of the market might catch a cold. Putting on an extra layer of clothes gives me the warmth against any potential cold snap. One rule I always practice: if I can’t make sense of the market, I take some money off the table. After Feb, I had reduced my market exposure to a more appropriate level. Past market trends point to a correction in March. Caveat Emptor, buyer beware. God bless 🙏

Please consider following us on telegram for the latest update on Lone Wolf investor by clicking on the link below. No form filling, no payment required, no collection of data, no data mining, no hard selling, no obligation.

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for education only. Buyer beware,do you own due diligence.

Comments

Post a Comment