Wolf Money(My views on Great Eastern offer)

Great Eastern Holdings(extract from end May portfolio update)

First of all before I go further, the views shared are mine, alone. It doesn’t reflect anybody views and it is also not to undermine the good work of the independent financial advisors which are been tasked to assess the fairness of this voluntary unconditional general offer by OCBC. Kindly do take my commentary with a pinch of salt given my vested interest in GEH. My view shouldn’t be taken as cardinal truth on what you should do with your GEH shares. Kindly do your own due diligence and seek professional advice.

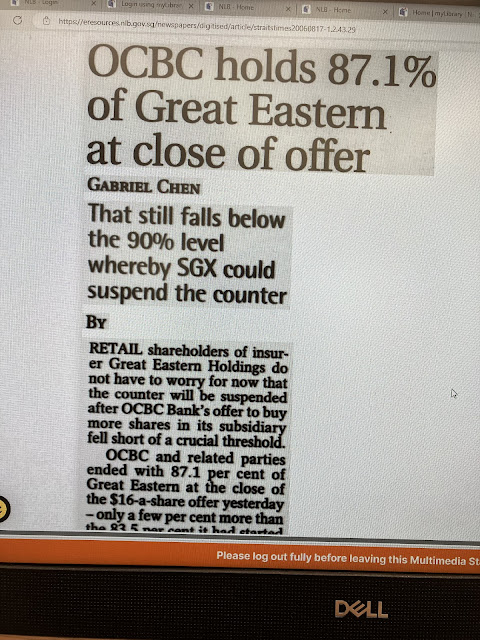

I praise and thank OCBC for starting the ball rolling with this privatisation offer. I believe the bank is capable of doing more for Great Eastern’s minorities. The offer of $25.60 by OCBC undervalues GEH by a mile. Personally, I would like to move on with my Great Eastern shares, but I can’t be giving half the house away for free with this offer. I can’t speak for others, but I do believe the offer is probably $600m to $700m shy of the minimum acceptable fair value for most GEH shareholders. Most will agree the minimum fair value per GEH share to be around $37-$38(1x estimated EV for FY 2024). I urge OCBC to do more with a better offer. The bank is one step away from the mountain peak call “Mt. Greatness”. Standing in the way of achieving the pinnacle is a small boulder named “$600m”. A higher offer at 1x embedded value will give the independent board of Great Eastern an easier time to sell the merits of the offer to its own minority shareholders.

A fair offer brings a lot of goodwill to OCBC. In all scheme of things, $600m is not a big sum for OCBC. It is less than a month’s worth of its current earnings. A clean deal helps OCBC brings closure to one of the longest takeover exercise in Singapore corporate history that stretches two decades. I pray for wisdom from all parties involved to come out with an amicable agreement, finding a middle ground where everyone can feel they have taken something positive out from this offer. OCBC is known to be the big brother of GEH. An offer by OCBC should reflected that special relationship. Thank you. God bless. I wish everyone good health. May God bring you peace and joy.

I will be waiting for IFA report before deciding what to do with my shares.

*not an inducement to buy or sell

Please consider following us on telegram for the latest update on Lone Wolf investor by clicking on the link below. No form filling, no payment required, no collection of data, no data mining, no hard selling, no obligation.

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for education only. Buyer beware,do you own due diligence.

Comments

Post a Comment