Wolf Money(Portfolio update for end May 2024)part 2 long post

Lone Wolf Fund(LWF)

Portfolio as at end of May 2024

1.) Cash

2.) Great Eastern Holdings(GEH)

Commentary

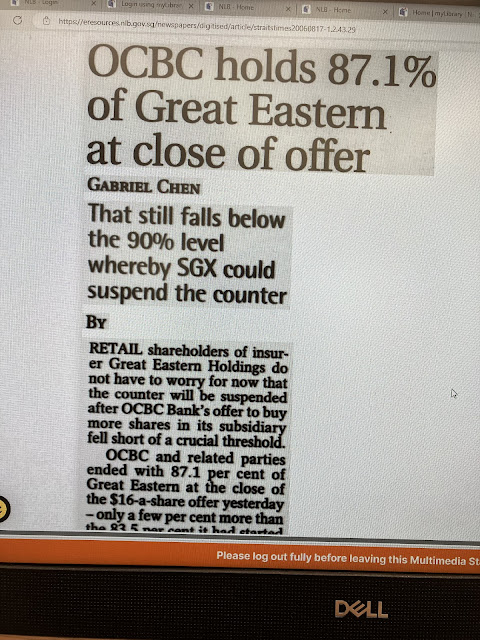

Konnichiwa! Hello from Japan. I pre-wrote this month’s portfolio update before I got on my flight to Japan. LWF had a good month due to Great Eastern Holdings privatisation offer. My gain for the month was 23.5%, bringing the ytd gain to a 5-years high of 30.5% (excluded dividend and cash yield). I did a sale in Boustead Singapore this month, much of my attention was on the takeover offer for GEH.

The US market continues to perform well, but Singapore market continues to be lacklustre. There are more articles in the media encouraging our SWF to step up their local market participation, to bring much needed liquidity and vibrancy to our stock market. I wish all parties involved a roaring success. All possibilities should be explored to revive our stock market. I hope to see all parties working as soon as possible because the clock is ticking away for our stock market. We can have long conversations about the details, but that alone can’t help our market. All necessary actions should follow through. A shock and awe response is required. A good stock market is good for the local economy.

Solving the undervaluation of the market and investor protection

The first agenda of the day is to solve the undervaluation of Singapore stocks. OCBC’s bid to privatise GEH should be keenly watched. If a big local financial institution could delist a systemically important financial institution at a bombed out price, it would affect the integrity and the valuation of the Singapore market greatly. Just think of it as the biggest and the nicest GCB in a certain area been bought at half their value, will it affect the price of the existing GCBs in that area? The delisting of GEH at bombed out price will be use by IFA for their future work on valuation report of other privatisation offer. Hypothetically, will our banks accept a 0.7x price to book offer to buy their banks from a third party bidder? You get what I mean.

I am more than willing to exchange my GEH shares for OCBC shares at 0.7x of their book value at an appropriate ratio to GEH shares if I am given that option. I am sure other GEH’s shareholders will consider that option seriously if there is one available.

The injustice suffered by minorities in recent years due to lack of investor protection, especially during privatisation offer, had many minorities up in arms and losing confidence in our market. I am always a bull on Singaporean companies, but if one can’t get fair value out of their investments, would anyone want to buy into Singapore stocks to subject themselves to low valuations and the constant low ball offers? I suffered two low ball offers within a year. One could heap praises on my good luck, but given the time spent on trying to identify undervalued stocks and the low returns on those low privatisation offers, it doesn’t do justice to my time. I was lucky I didn’t buy the stock at “fair price” that some experts claim to be worth much more. Some of my fellow shareholders weren’t so lucky. Some shareholders held their stocks for more than a decade at much higher prices. One can blame the companies for the low ball offer or one can blame themselves for putting too much faith in the Singapore stock market? But then again, ain’t we supposed to trust the process and our market to give us full value for our investment? If a young investor can’t confidently get fair value for their investment in the Singapore market. Will they invest in our market? Probably not. The increase in investor protection should be given a high priority in the authority’s work on reviving our market.

Appointment of IFA by SGX

The action by the independent board to appoint an independent financial adviser during a takeover offer should be scrutinised. The appointment of IFA should be done on the instruction of SGX with the exchange randomly appointing the IFA to the takeover company. Work done by the IFA will be held accountable to the stock exchange only. A pool of IFAs that the stock exchange can appoint reduces the fear of IFA speaking their mind. Some IFAs have past or potential future business relationships with the acquirers or the target companies. I like to see those opinions such as fair, but not reasonable or adequate, but not compelling to be disallowed. It gives the perception of a serious lack of conviction by IFA in their work to give a firm opinion.

Existential crisis, relevancy and investors education

With three more companies going on privatisation, the number of listings will fall further. SGX must double down on their effort to engage young investors. A good place to start will be all the investment clubs in our universities and polytechnics. I am not sure if SGX knows. People under the age of 28 years whom I have spoken, could tell me more about Alibaba and Tesla than they could tell me about ST Engineering. If the younger generation is not following our market, where is the next generation of Singapore stock investors coming from? Are they supposed to come from MSCI index focus fund? Unlikely. 5 Singapore stocks were kicked out of the list recently with no addition due to increase weightage given to the Indian and the Chinese market(I previously mention why MSCI fund can’t be a strong buyer of Singapore stock). How about using CPF accounts and CPF funds? Moral hazard was cited. Family office? Worry about them not coming to Singapore if we “force” them to buy Singapore stocks. GIC? Mandate incompatibility. All sorts of reasons were given. I am not trying to induce fear, but I believe the Singapore stock market is facing an existential crisis if nothing is done soon. Many well-paying white-collar jobs in the financial sector relating to the equity market will be lost forever if we do nothing. Key decision maker can consider a sale of our exchange to a larger stock exchange group if reviving our stock market is in the too hard to-do list. Let the acquirer do the hard work for us. A walking zombie served no one’s interest. Over the past decade, it has been tough for all market participants. The present situation has been a slow descend into the inevitable, the demise. The exchange needs a hard look at its relevancy. All been said, I still believe it is not too late to turn around the situation. With determination, the stock exchange can regain lost ground and be a big contributor to Singapore’s financial sector. The exchange holds so much promise given our wealth hub status of the world. It would be a big mistake for our equity market to miss this once is a generation golden opportunity. Time to do something and the time is now. I will be cheering you all the way.

Local listed companies have a role to play. They should participate in more roadshows to gain a wider audience. Undertaking value enhancement exercises can help to improve valuation. CEOs of listed companies can be tasked to give quarterly presentations, even if that is not required by listing rules. A good CEO can be the best sales person of any listed company.

Great Eastern Holdings

First of all before I go further, the views I shared are mine, alone. It doesn’t reflect anybody views and it is also not to undermine the good work of the independent financial advisors which are been task to assess the fairness of this voluntary unconditional general offer by OCBC. Kindly do take my commentary with a pinch of salt given my vested interest in GEH. My view shouldn’t be taken as cardinal truth on what you should do with your GEH shares. Kindly do your own due diligence and seek professional advice.

I praise and thank OCBC for starting the ball rolling with this privatisation offer. I believe the bank is capable of doing more for Great Eastern’ minorities. The offer of $25.60 by OCBC undervalues GEH by a mile. Personally, I would like to move on with my Great Eastern shares, but I can’t be giving half the house away for free with this offer. I can’t speak for others, but I do believe the offer is probably $600m to $700m shy of the minimum acceptable fair value for most GEH shareholders. Most will agree the minimum fair value per GEH share to be around $37-$38(1x estimated EV for FY 2024). I urge OCBC to do more with a better offer. The bank is one step away from the mountain peak call “Mt. Greatness”. Standing in the way of achieving the pinnacle is a small boulder named “$600m”. A higher offer at 1x embedded value by OCBC will give the independent board of Great Eastern an easier time to sell the merits of the offer to its own minority shareholders.

A fair offer brings a lot of goodwill to OCBC. In all scheme of things, $600m is not a big sum for OCBC. It is less than a month’s worth of its current earnings. A clean deal helps OCBC brings closure to one of the longest takeover exercise in Singapore corporate history that stretches two decades. I pray for wisdom from all parties involved to come out with an amicable agreement, finding a middle ground where everyone can feel they have taken something positive out from this offer. OCBC is known to be the big brother of GEH. An offer by OCBC should be reflecting that special relationship.

OCBC, kindly be gentle with the GEH’s minorities, you are dealing with a group of mom and pop shareholders that have no financial resources and the legal expertise better than yours. Most of us are everyday Singaporeans trying to make ends meet. Does it bring any pride to the bank, if you, the bank, are able to succeed with a low ball offer? A righteous bank always does the right thing. The whole privatisation is more than just saving $600m. More than 90 years of legacy is at stake and how it defines the bank’s core value For Now, and Beyond. It is very easy for any company to come out with grand statement on core value, but those who walk the talk is what separate the men from the boys. Over to you, Mr. Chulia Street banker.

Integrity

“We hold ourselves to the highest ethical standards and always do the right things, even when no one is watching.

We always act with integrity and honesty, in line with the spirit and letter of our code of conduct.

By upholding integrity, we honour the trust of all our stakeholders, ensuring fair and transparent outcomes.”——OCBC core value.

Thank you. God bless. I wish everyone good health. May God bring you with peace and joy.

*I will be waiting for IFA report before deciding what to do with my shares.

*not an inducement to buy or sell

Boustead Singapore(sold)

Boustead reported another strong result with profit up 42% for FY2024. There was a big bump up in dividends from 2.5c to 4c. Bring the full year dividend to 5.5c. Boustead Singapore even with their strong result still trades at a big discount to fair value given the share was up over 20% this year. If our market is efficient, Boustead Singapore stock would have traded closer to the $1.20-$1.40 if we base on the valuation ten years ago. The depressed valuation required self help. The company can consider any value enhancing measures to boost their stock market valuation. The company has been underserved by the market which is no fault of theirs. Nevertheless, I give the managers at Boustead the credit for navigating a complex and difficult build environment in Singapore. I sold my holdings at more than 30% return, dividends included with a holding duration of 1.5 years since the Boustead Projects era. Lone Wolf Fund holds no interest in the company. The company remains undervalued. Cash will be on hold for future deployment.

Cash

There is a substantial increase in cash due to a sale in portfolio company. No movement at the out department.

Summary

Singapore’s exports have been falling due to multiple factors for a few months now. Given our strong currency. It makes our export less competitive. It is unlikely our SGD is going to be weaken given every other countries is adopting currencies debasement policies. The upside you get from a strong currency, one gets better purchasing power when traveling overseas. The local retail environment is weakening with retail sales falling in April. Tourists’ arrivals also came down in April. Property sales is down too. All these figures point to a difficult operating environment for domestic businesses. Listed companies that rely on domestic spending might suffer from poor sales. Going to a cheaper destinations to spend our Singapore dollars is going to put pressure on domestic spending. Will the free flowing border between JB and Singapore via RTS/MRT in 2026 make domestic spending even worse?

The market is probably close or near peak. Just my random opinion. One flexibility of being a lone wolf investor, one could stay fully in cash without getting the sticks from fund investors. That itself is a strong advantage to have. I am expecting a tough 2nd half 2024 and 2025 for the stock market. A substantial pull-back is on the card. One top local banker sold shares in his bank, although one swallow doesn’t make a spring, but given his position as a top banker, he has “helicopter” view on the Singapore economy. Another top banker from the largest US bank gave warning on inflation coming back in 2025 which may force the Fed to hike rates instead of lowering rates, that can’t be good for the market. The risk reward especially in the US market is increasingly lopsided. The current US stock market rally is in its 19th month if we take Oct 2022 as the starting point of this current bull run. Typically, a bull market can go on for a duration of 18 to 24 months. Is it wise to stretch one’s luck? I wouldn’t recommend. I might have to settle with a return closer to risk free rate sometime down the road given I am generally a conservative and cautious investor. Just think of me playing the position of a defender, stronger in defensive duty with rare moment playing up field. This is your Lone Wolf signing off. God Bless.

Please consider following us on telegram for the latest update on Lone Wolf investor by clicking on the link below. No form filling, no payment required, no collection of data, no data mining, no hard selling, no obligation.

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for education only. Buyer beware,do you own due diligence.

Comments

Post a Comment