Wolf Money(Wilmar International)

I took a position in Wilmar International. All the bad news seem to be pouring at the company. From allegation of corruption in China which the company has denied to industrial actions at Wilmar Sugar Australia. There is no shortage of bad news at Wilmar.

Two quick points. I am buying Wilmar due to the appointment of George Yeo as their independent director. The appointment gives Wilmar great geopolitical insight in the countries they operate. George Yeo, our ex-foreign minister has bought shares in the company at an average price of $3.105 as disclosed on the 7th June announcement. Although he is yet to be proven as a great stock pundit but I believe he will add value to Wilmar’s board greatly.

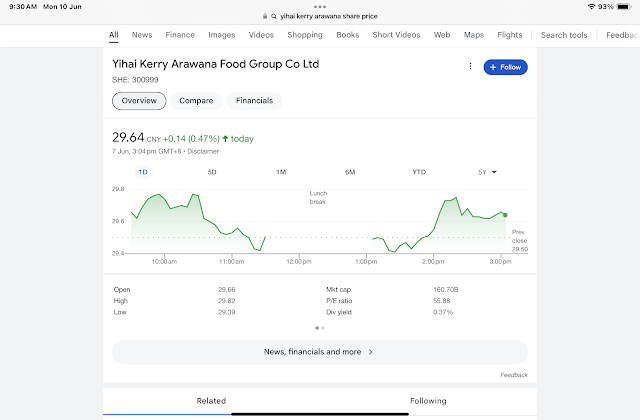

The second point, Wilmar has extensive reach to two most important markets of the 21st century. India via listed Adani Wilmar and China via listed Yihai Kerry Arawana Food Group(YKA). YKA has a market cap of more than SGD 29b which Wilmar owns 89% of the company. The stake alone is worth more than SGD 25b vs 19.3b market cap of its listed Singapore parent. Effectively one is getting YKA at a discount and the rest of Palm Oil and Sugar businesses, Wilmar Adani and other subsidiaries for free without consideration for its debt. The high debt which some analysts raise might mistook the company as a debt laden company but most of the debts are trade financing related for purchasing of commodities. Commodities are as good as cash in the eyes of management.

I can’t proclaim to know the complexity of Wilmar’s business but the stock is trading close to 5 year low. It does look cheap on first glance. Share is trading at 9x p/e with a price to book ratio of 0.73x. It appears cheap enough for me to start an initial purchase. The stock comes with a 5.5% yield at the time of writing.

Major support for the stock at 3.07 and $3.00(green line). Trading range between $3.00 to $4 over the past decade.

Please consider following us on telegram for the latest update on Lone Wolf investor by clicking on the link below. No form filling, no payment required, no collection of data, no data mining, no hard selling, no obligation.

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for education only. Buyer beware,do you own due diligence.

Think it is depressed for past 3-4 years as china econony is not doing well and may well remain so. Second point is nowadays too many ppl and institutions shun china stocks. But that being said, i think there are some china stimulus that may help.

ReplyDeleteBut i agree second point is well argued on the fact that it is undervalued.

Thank you for your comments.

DeleteWilmar might be one of the only few China play plus India play that has a sizable world wide business.

I am comfortable with the management and board. They are so important now given the spike in low ball and corpy governance issue plaguing our market.

Rmb to factor sgx liquidity discount also

ReplyDeleteThe market never give an Indian premium lol. It is our stock market that is the problem.

DeleteRegards

Lone Wolf Investor

UOL at $4 may be chance to buy too

ReplyDeleteI don’t know. No comment. Maybe you like to study the over movement of Wee first. 👍

DeleteYou mean shareholding changes?

ReplyDeleteCorrect. You can take reference from Haw Par.

DeleteWarm Regards

Lone Wolf Investor

The only clue i got from haw par is it holds uol and uob and is a cash rich company. They like cross holding structure to protect themselves

ReplyDelete