Wolf Money(SIAS book launch)

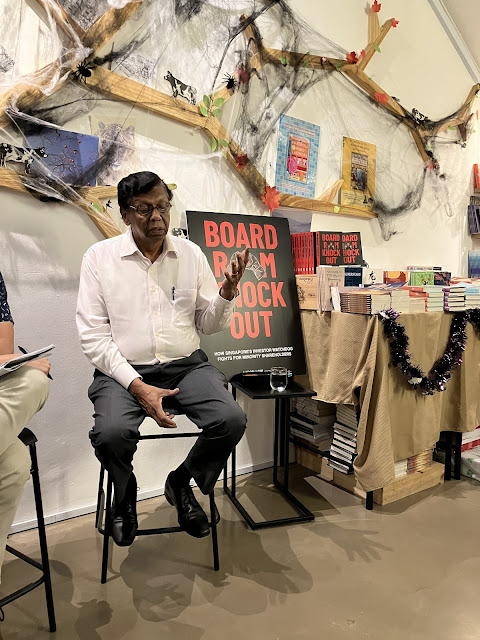

Yesterday evening, I attended a book launch organised by SIAS. The title, BOARDROOM KNOCK OUT, HOW SINGAPORE’s INVESTOR WATCHDOG FIGHTS FOR MINORITY SHAREHOLDERS, was a collection of SIAS’s history and achievements over the past 25 years. The evening at Book Bar was a unique setting for a book launch. The Founder, President and CEO of SIAS, Mr. David Gerald was on hand to sign autographs for guests. The small group of guests were mingling and sharing their hope and outlook for our stock market. It was an intimate affair.

During the event, there were many interesting stories shared. SIAS was founded by Mr. David Gerald under very difficult circumstances. It was born in the aftermath of the CLOB saga which 172,000 Singaporean investors faced the prospect of losing their life savings due to the Malaysia government outlawing CLOB shares traded on the Singapore exchange. Some investors couldn’t take the sudden shock which resulted in heart failure. Some investors were weeping their hearts out as the situation turned dire. Then came Mr. Gerald’s calling. He was emotionally drawn by the noble cause of helping retail investors to get back their hard-earned money. As I quoted the legend, “If no one comes forward to help the victims, there will be no one to help them”. After the long battle, SIAS was successful in negotiating a successful outcome with Malaysian government to release funds held in Malaysia to retail investors in Singapore.

Questions were asked during the book launch. Mr. Gerald was asked about his most memorable and most difficult battle undertaken on behalf of retail shareholders. For the past 25 years, there have been many countless battles fought and won. The most memorable one was the CLOB saga which gave birth to SIAS and the most regrettable case was Hyflux which went into liquidation with many retail investors getting little or no money back from their investment despite great effort by SIAS to savage the situation. Mr. Gerald also offered his wisdom on getting things done behind boardroom doors. In Asian context, the Asian bosses like to be given “face” when engaging a serious topic like improving buyout offer, preferring light touch over open confrontation. This ultimately increase the chances of a positive outcome for all parties.

The author, Aaron Low, formerly with The Straits Times, did a quick fire questions on his impressions about some prominent business and political leaders he had met over the years. Mr. Gerald had to answer them with one word. He described LKY as Hero. SM Lee as Nice and J.Y Pillay as Rockefeller.

I joined in with my own question. I asked, have MAS review group sort his view on how to improve our market? He was contacted by the review group. He felt more should be done to empower SIAS to improve investor education in Singapore. In his observation, shareholder activism has improved greatly over the years and more retail investors especially younger ones, are joining SIAS as members. SIAS does regular engagements with investment clubs at our universities to improve their investment literacy.

My heartfelt thank you to SIAS for its many years of thankless service to the community. Without their support, retail shareholders wouldn’t have a legitimate channel to voice their concerns. I am the beneficiary of SIAS initiatives occasionally where they managed to nudge the majority shareholders to pay a higher price during a takeover offer. I like to wish SIAS a happy 25th anniversary with more good years to come.

I would also like to express my appreciation to Mr. Gerald, Eileen from SIAS marketing and her team for organising such a wonderful event. My thank you goes to author, Aaron Low for sharing his journey of creating this book. I look forward to more events organised by SIAS. Anyone wanting to know more about shareholder activism in Singapore should get a copy of the book. The book is available at Book Bar and all major bookstores.

Do watch out for the book review soon. God bless.

Please consider following us on telegram for the latest update on Lone Wolf investor by clicking on the link below. No form filling, no payment required, no collection of data, no data mining, no hard selling, no obligation.

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for education only. Buyer beware,do you own due diligence.

Comments

Post a Comment