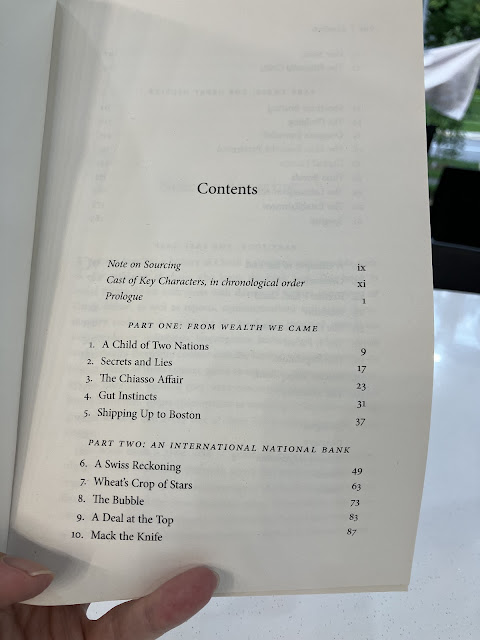

Wolf Review(Meltdown. Scandal, Sleaze and The Collapse of Credit Suisse by Duncan Mavin)

This title by Duncan Mavin detailed the events that lead to the collapse of one of the most iconic Swiss banking giant. The book gathers information from insiders who share the inner workings and culture of Credit Suisse(CS).

The history of CS is a tale of fortunes won and lost, of controversy and disagreement, of dispute and accusations. The events that led to the demise of the banking giant were a concoction of failure in epic proportion which ultimately bought down the 167-years-old bedrock of the Swiss financial industry.

Credit Suisse was founded in 1857 by Alfred Escher. He saw a need for a bank to finance Switzerland’s ever growing need for infrastructure in the mid 1800s. His clout in politics and in business propelled CS as the go-to bank.

Switzerland’s banking industry didn’t take off till the Great War. Due to Switzerland’s neutrality, it became a safe place for wealthy individuals and families to place their money. Occupied countries placed huge sums of money with the Swiss bank with an eye to future reconstruction of their countries. The exponential growth in the Swiss banking sector came after the government passed banking secrecy legislation which forbids anyone from disclosing details of their clients’ accounts. The intention was great until tax evasion and money laundering started purging the industry. Banking secrecy is no longer a scarce cow as the global government threatens to put the Swiss banking sector on the red list.

The deregulation during the 80s sparkled a frenzy into investment banking by American banks. The US banks were muscling into the traditional Swiss banking sector. The increased competition caused the Swiss banks to look outward to the US for new business opportunities. Credit Suisse was not alone in pursuing investment banking business in America. They had a joint venture with First Boston Bank. It was a bad decision from the start as First Boston Bank had higher risk appetite compared to the conservative Swiss Bank. A mythical banking group was founded in the name of Credit Suisse First Boston. The messy arrangement caused friction on both sides of the spectrum. As banking becomes more global, bankers representing CSFB from America and Europe had their horns locked over the same pool of customers. The purchase of First Boston was the first of many misssteps that led to the eventual demise of CS.

The problems among Swiss banks were not confined to just competition from US banks. Jewish descendants were breathing down their necks to recover stolen funds placed by the Nazi during World War 2 which were rumoured to be in the billions. CS happens to be one major beneficiary of those ill-gotten funds. In the end, the Swiss banks had to cough out USD 1.2b to settle the lawsuit.

Expensive settlements with the Department of Justice never stop the rogue behaviour. The bank continues to help clients avoid detections imposed by the US government on those countries subjected to US sanctions. Some dodgy practices, including tax avoidance and problematic loans were part of the endless malices which eventually led to the failure of the bank.

The bank was unable to shake off financial scandal after scandals. 1MDB, Tuna Bonds, spygate, wirecard and the Lescaudron Affair which involved a multi-million lawsuit, playing out in Singapore’s court. CS was told to pay USD 743m in compensation to an ex-Prime Minister client for disregarding fraudulent conduct by their bankers.

CS’s involvements in headline-blasting scandals, from Luckin to Greensill to Archegos were common, There was never a dull day without CS appearing in the financial headlines for the wrong reasons. The final straw that breaks the camel’s back came in early Oct 2022 when an Australian journalist from ABC twittered about a major Wallstreet bank on the blink of collapse. Even though no name was mentioned, everyone in the market was speculating about CS as the bank in trouble. Clients with billions started withdrawing that added to an already weak financial position at the bank. The top executives had no idea how to handle a digital bank run. A brief fundraising exercise involving the Saudi National Bank came too late with the Swiss banking regulator closing in on Credit Suisse’s problem . Time was up for the 167-years-old institution. A government engineered a CHF $3B takeover involving UBS was seen as a last ditch to restore the integrity of the Swiss banking industry. The ghost of the bank continues to have an adverse impact in the market. CS’s AT1 USD $16b bonds are still under contestation in many courts around the world.

I can summarised in my own words, the demise of CS was due to weak management control and misalignment of bankers’ interests to those of the bank. The bankers were lining up their pockets with huge bonuses promoting financial products, which sometimes, at the detriment of clients’ interests, is a red flag to any business running on trust. A business that relies on trust needs their integrity to be intact, without them, so goes the clients.

CS wouldn’t be the last bank in trouble, the next “Debit Suisse” might be hidden in some obscure corner waiting to happen.

The book goes onto Lone Wolf Investor recommendation for its detailed account of the internal problems at Credit Suisse. It is a well written detective title to spend the weekend reading.

Please consider following us on telegram for the latest update on Lone Wolf investor by clicking on the link below. No form filling, no payment required, no collection of data, no data mining, no hard selling, no obligation.

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for education only. Buyer beware,do you own due diligence.

Comments

Post a Comment