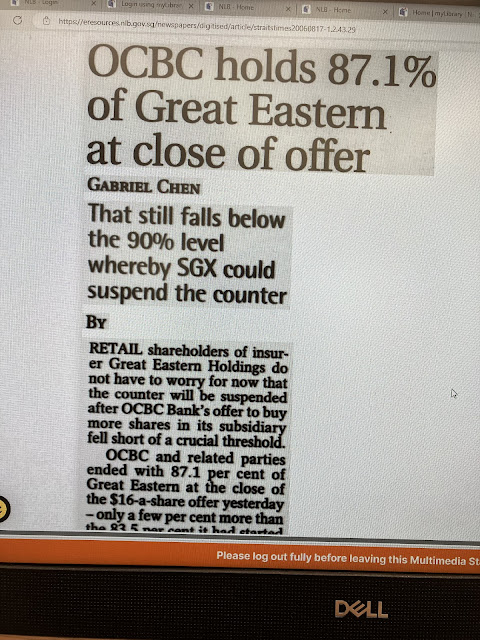

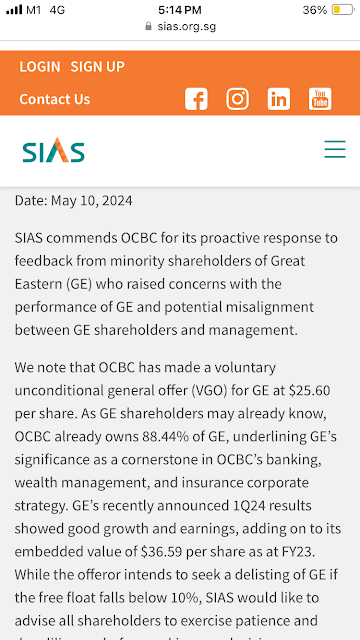

Statements released by SIAS and Minority Leader, Chin Woo. SIAS advises minority shareholders of Great Eastern Holdings to wait for IFA report before deciding the outcome. Minority Leader, Chin Woo, called for b.o.d of Great Eastern to maximise value for all shareholders by conducting an open auction for Great Eastern to solicit for higher offer from third party bidder with OCBC given the first right of refusal. The offer in my personal opinion still undervalues Great Eastern by a mile. To be honest, Lone Wolf want to sell my GEH shares but I can’t be giving half the house away. I will wait for IFA report before making any decision*. *not an inducement to buy or sell. Please consider following us on telegram for the latest update on Lone Wolf investor by clicking on the link below. No form filling, no payment required, no collection of data, no data mining, no hard selling, no obligation. https://t.me/joinchat/oCgkD3sQFRMzMWM1 Disclaimers All investments is highly speculative in n