Wolf Money(SBS Transit Q3 FY2023 update)

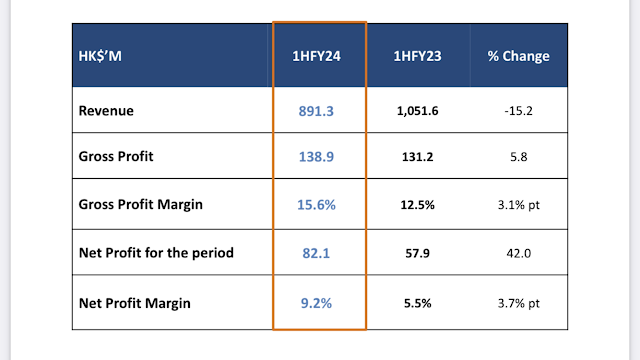

(Credit: SBS Transit) SBS Transit Q3 update shows a 4.7% increase in profit. The numbers were helped by interest income generated from their cash pile. Cash balance went up another 25m to around $370m or $1.18 net cash per share, which made up 47% of their market capitalisation even after accounting for 17m dividend paid in August. October train ridership for DTL,NEL and LRT had reached 97.5% of pre covid. No dividend was declared for current quarter. God bless. Please consider following us on telegram for the latest update on Lone Wolf investor by clicking on the link below. No form filling, no payment required, no collection of data, no data mining, no hard selling, no obligation. https://t.me/joinchat/oCgkD3sQFRMzMWM1 Disclaimers All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent i