Wolf Money(portfolio update end Sept 2022)early release

Portfolio as at end of Sept

1.) Cash

Commentary

The biggest event of the year must be the passing of the Queen of England. I got great respect for her enduring and unwavering resolve to serve out her role as Queen till her death. In the modern era, people just don’t have that kind of loyalty and patience towards their company and job. Job hopping is common and loyalty counts for little, companies likewise. To have the Queen in the job for 70 years is no mean feat, a dedication few people could match.

King Charles III had taken over as the Sovereign of UK and 14 other countries which had the Queen as their head of state. In the Carolean era, there are no carol to lift his spirits. I personally felt for the new King, most people at his age would be enjoying their retirement, a huge contrast to his increasing responsibility. He also inherited one of the most challenging times in the history of British Crown. There are strong push back against monarchy representation as head of state in Australia and New Zealand, Scottish National Party is seeking a new referendum for Scotland to leave UK with Northern Ireland potentially following the way of the Scottish. The British economy is in a mess with inflation running wild, the legacy problems arise from brexit are yet to be sorted out, the falling sterling against USD to a 37 years lows and families feud among the Royals are big headache for the new King.

I find King Charles a pleasant person. I met him in a public domain 4 years ago when he visited Singapore( how cool was that 😎 ! Lone Wolf had his 3 seconds audience with the King ). I am sure after been an apprentice to the Queen for 70 years, he can’t be more prepared for his new role as King so long the ink wells and the leaking fountain pens are taken away. In Singapore, we are faced with the pressing and critical decision on changing our road name from Prince Charles Crescent to King Charles Crescent. I suggest forming a “rename our road committee” to launch a public consultation exercise to consider the urgent matter. God save our road.🙃

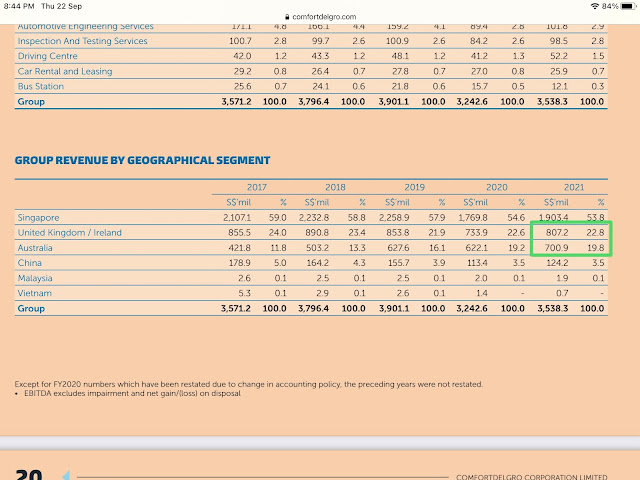

The US market had broken the lows set in June. S&P 500 3667 was the major support broken. There is a possibility of another 10 percent downside to around 3300. LWF is fortunate to be holding its own with YTD return at positive 9% down from 11% the previous month. Our market experienced some brutal selling. LWF wasn’t spare. Previously I mention the possibility adding Comfortdelgro back to LWF after the STI index adjustment. CDG transition out of STI didn’t cause the share price to drop sharply but I am still sitting on the fence due to the falling Pound and Aussie dollars. I had no idea how the debasement of Pound and Aussie dollars are going to affect their financial result. UK and Australia market contributed close to 43% of total revenue last year. Pound is down more than 14% against SGD with Aussie dollars faring better with a 4% drop against SGD. I have no idea how well CDG hedge their pound exposure but I do have my concern. Overall I think their business is improving as many countries which they operate in are welcoming holiday starved visitors again. The potential currency translation loss might take the shine away. The recent drop in oil price is helpful in lowering CDG fuel cost. I am watching development closely without any surety I would buy back the stock. My decision is data driven.

SMG, my former “squeeze” had a privatisation offer at 37c, just one month after I sold the stock. Congratulations to those who had more conviction than me. Bye SMG, you wouldn’t be missed.

Boustead Projects(BP)

Boustead Projects(BP) is the only addition to Lone Wolf Fund this month. I did a detail thesis on the company, please refer to the link. The recent increase in land betterment charges(LBC) of over 8% for commercial building in Orchard had made it more costly for developer to tear down old buildings and build new. With the new increase in LBC, Boustead Projects purchase price of Bideford building is looking more like a bargain with each passing day.

BP investment into Vietnam industrial is timely where demand for industrial building are increasing. KTG industrial, BP partner in Vietnam mention in a recent update “ Vietnam's enhanced position has continued to boost the demand for industrial real estate investment" - the highlight of industrial real estate that Agrisco assessed in the investment strategy report of Quarter 4 of 2022. The demand for renting factories and warehouses in the logistics, electronics, automotive, and e-commerce sectors has increased sharply and is forecast to continue to grow by 20% per year. More than 76% of European business leaders expect to increase FDI into Vietnam before the end of the third quarter of 2022. In the North, strong development areas such as Bac Ninh, Hai Duong and Hung Yen have more than 80% occupancy rate, up 5-10% over the same period. In the south, thriving areas such as Long An, Binh Duong and Dong Nai, Vung Tau also have impressive occupancy rates of more than 85%. In addition, large corporations such as Samsung, LG Display, Goertek have plans to expand and invest in Vietnam. Benefiting from the Government's policies on improving infrastructure and Decree 35/2022/ND-CP, the supply is forecasted to expand to about 14,000ha in the North - South regions and develop sustainably for industrial real estate. KTG Industrial currently owns land bank in expensive locations and rich in human resources such as: Tam Phuoc A and B; Nhon Trach Textile; Nhon Trach 2 Phrase 1; and Nhon Trach 3B; and Nhon Trach 3B.”—-KTG Industrial. I am sanguine on the demand for industrial space in Vietnam.

Cash

Keeping cash seem to be the winning formula this year as yield on cash is improving. Risk free rate stands at around 3% in Singapore. The borrowing cost had spike up too. Company with poor balance sheet might face increasing funding cost. As rate continue to rise, I am expecting more companies to turn insolvent. Jump in risk free is likely to have an impact on asset prices. Any reit which formerly paid a 5 percent dividend might look less attractive given risk free rate is at 3 percent. If risk free rate jumped to 4 percent, the price of yield instruments might be under pressure. Reits trading at a minimum 6-7 percent yield might be norm going forward. Singapore Corporate medium term bond at a minimum 5 percent yield might be the norm for new issue. My rainy day fund continue to take baby steps into Singapore Savings Bonds.

After the huge correction in US market, some companies are looking more attractive. I will be looking out for companies with good cash holdings, little or no leverage, a thriving business even with current tough operating environment. One would never know, a crown jewel might just fall onto my lap. I got a gut feeling Fed is close to pivoting(by end of this year) which can help the falling stock market find its feet again. I also like gold and Japanese Yen for next 6-12 months, I am not too sure how this is going to be helpful to my readers towards making their own investment decision. I continue to like cash, cash had a calming effect on one’s wellbeing so as to achieve a better decision making outcome and companies with plenty of cash are likely to weather any market volatility better. In the meantime, keep calm and carry on searching. Market goes in cycle, good time be humble, bad time don’t be despair. Chin up, life goes on. God bless!

Please follow us on telegram for the latest update on Lone Wolf investor by clicking on the link below

https://t.me/joinchat/oCgkD3sQFRMzMWM1

Disclaimers

All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which we believe are reliable but are without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way whatsoever warrant or guarantee the success of any action you take in reliance on our statements. All information provided are for information only. Buyer beware,do you own due diligence.

Comments

Post a Comment