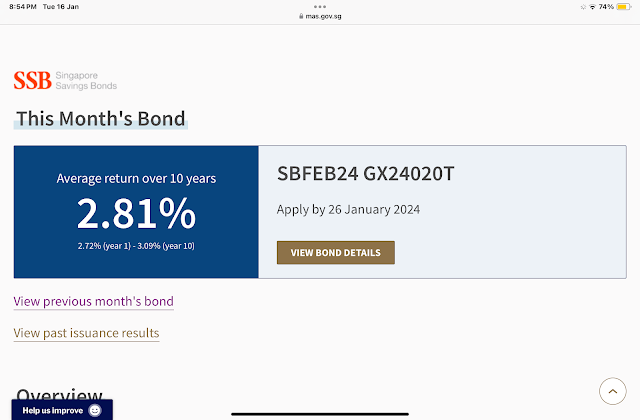

Wolf Money(Singapore Savings Bonds Feb 2024 result)

A crash in SSBs bond yield to 2.81% also ushered in a big drop in demand. Only $175.2m of the $900m issued found buyers this month. Yield will be slightly better for March SSBs. Thank you. God Bless. Contribution by Derek@valueinvestments chat group. Thank you. Please consider following us on telegram for the latest update on Lone Wolf investor by clicking on the link below. No form filling, no payment required, no collection of data, no data mining, no hard selling, no obligation. https://t.me/joinchat/oCgkD3sQFRMzMWM1 Disclaimers All investments is highly speculative in nature and involves substantial risk of loss. We encourage our reader to invest very carefully. We also encourage reader to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Much of our information is derived directly from information published by companies or submitted to governmental agencies on which ...