Wolf Money(world market review 3-9 Oct 2022)

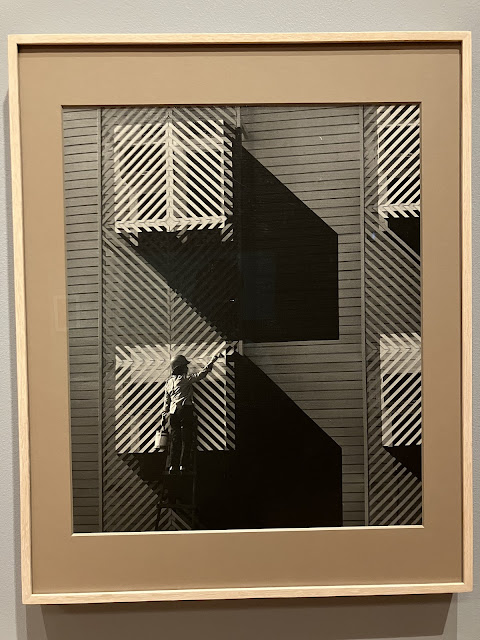

Koeh Sia Yong Singapore 1937 Orchestra in Equator Art Society circa 1968 Collection of National Gallery Singapore Market Summary 3-9 Oct 2022 🇺🇸 🇺🇸 🇺🇸 🇺🇸 🇺🇸 - US starts fiscal year with record US$31 trillion in debt - Fed looks almost certain to deliver 4th straight 75 basis pt interest rate hike next mth as job market fails to cool + US non-manufacturing PMI at 56.7 in Sept from 56.9 in Aug, accounts for >2/3 economic activity - US imposed new rules restricting exports of semiconductors on China’s access to advanced chip technology - US widens investment ban to China’s BGI Genomics, drone maker DJI - US added China’s top memory chipmaker YMTC and 30 others firms to unverified trade list - US mortgage rates rise for 7th week to highest in 16 years of 6.75% + US jobless rate dropped to 3.5% from 3.7%, nonfarm payrolls added 263,000 jobs in Sept + US private employers stepped up hiring in Sept, rose by 208,000 jobs: ADP - US co...