Wolf Money(world market review 8-14 Nov 2021)

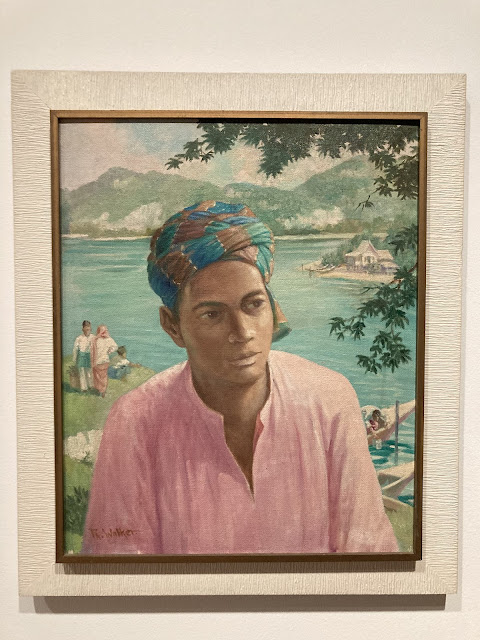

Richard Walker British 1895-1989 Hari Raya - Gathering at the Ferry Collection of National Gallery Singapore Market Summary 8-14 Nov 2021 🇺🇸 🇺🇸 🇺🇸 🇺🇸 🇺🇸 - US inflation surges to 30-year high in Oct, consumer prices jump 6.2% YoY - US govt posted US$165bn budget deficit for Oct, 42% lower than US$284bn shortfall a year earlier + US social spending of US$1.75 trillion package may include a tax break apply to most millionaires - US consumer confidence hits 10-year low in Nov amid rising inflation + Biden and Xi to meet on Tue via video link + US getting traction with China in Phase 1 deal talks: trade chief Tai - Biden signed bill to tighten telecoms equipment oversight + Biden said chief executives of major US retailers assured him store shelves would be stocked in time for holidays + US eyes Jan rollout projects to counter China’s BRI, include vaccine manufacturing hub in Africa, renewal energy supplies - Fed warned China’s real estate sector including Evergrande have