Wolf Money(world market review 12-18 Sept 2022)

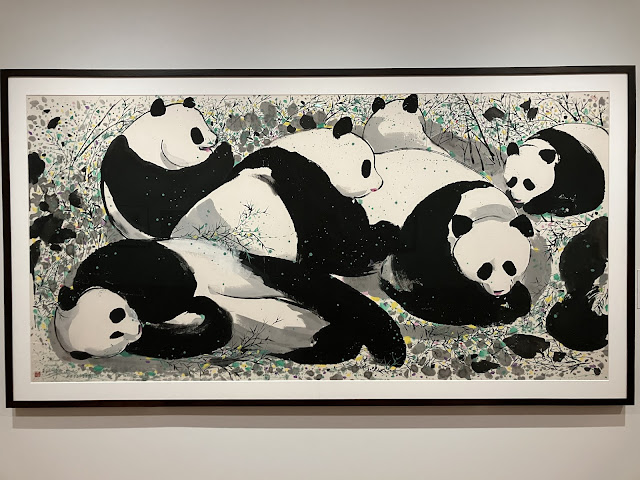

Wu Guanzhong China 1919-2010 Panda circa 1992 Gift of the Artist Collection of National Gallery Singapore Market Summary 12-18 Sept 2022 🇺🇸 🇺🇸 🇺🇸 🇺🇸 🇺🇸 - US inflation in Aug rises faster than expected at 8.3% - Biden singed executive order urging scrutiny of deals involving critical technologies + US consumer confidence grows slightly in Sept at 59.5 pts in Sept, up by 2.2 MoM + US retail sales up 0.3% to US$683.3bn in Aug + US business inventories increase 0.6% in July vs previous mth - US industrial production down 0.2% in Aug vs July - Wall St drops to 2-mth lows due to recession fears - US IPOs represent only 14% of US$153bn this year fetched globally so far this year - US 30-year fixed-rate mortgage rates rise over 6% for the 1st time since 2008 - US banks deposits dropped to US$19.562 trillion as of June 30, plunged by record US$370bn, 1st decline since 2018: WSJ - US plans to broaden curbs shipments to China semiconductors used for AI and chip-making tools n