Wolf Money(world market review 10-16 April 2023)

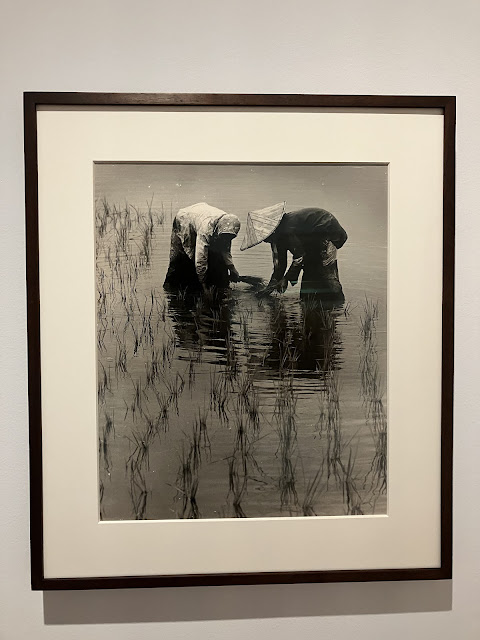

Lee Wen Singapore 1957-2019 Splash circa 2003 Collection of Singapore Art Museum Market Summary 10-16 Apr 2023 🇺🇸 🇺🇸 🇺🇸 🇺🇸 🇺🇸 + US inflation rose 0.1% in Mar and 5% from a year ago, lowest level since May 2021 - US retail sales down 1% in Mar from Feb, sharper decline then 0.2% fall in Feb + Fed unlikely to raise interest rates in Jun: Goldman Sachs - US public debt will continue to rise in coming years amid increased govt borrowing: IMF - US debt-to-GDP ratio projected to be 122.2% this year, expected to rise further to 136.2% of GDP in 2028 - US banks may tighten lending further and negate need for more rate hikes: Yellen - US regulator called for greater scrutiny of hedge funds after govt bond turmoil last mth - Dollar headed for longest stretch of weekly losses in almost 3 years - JPMorgan, Wells Fargo and BoA have lost US$521bn in deposits over past year, drop reach US$61bn inQ1: banking analysts + US crude oil inventories rose by 600,000 barrels to 470.5m + J